If you want to find real, accurate information on inflation, you need to ignore what the Fed says and focus on what’s happening for real businesses.

The Fed will never give an accurate portrayal of inflation because doing so would reveal that:

1) The Fed has been lying about inflation levels for decades.

2) The Fed did this to “paper over” declining living standards in the US (using cheap debt to mask incomes that are trailing relative to rising costs of living).

——————————————————————–

Looking for BIG gains from the markets?

Our options trading service The Crisis Trader returned over 40% in 2017.

This comes on the heels of a 19% return in 2016 and a 60% return in 2015.

Best of all, this system couldn’t be simpler: just one trade, made once per week.

Get FOUR trades for just $99 today.

Most subscribers make 3X that from a single trade!

This offer expires Friday at midnight.

——————————————————————–

For this reason, if you want to get a decent understanding of real inflationary pressures, you need to look into economic data from businesses that are actively involved in the economy.

To whit:

Worldwide data have recently made clear that producer-price increases have picked up steam. That’s led bond buyers to begin wagering that consumer inflation could be soon to follow, with U.S. breakeven rates above 2 percent in many tenors for the first time since March.

Source: Bloomberg

And…

The ISM Prices Index registered 69 percent in December, an increase of 3.5 percentage points from the November level of 65.5 percent, indicating an increase in raw materials prices for the 22nd consecutive month.

In December, 41 percent of respondents reported paying higher prices, 3 percent reported paying lower prices, and 56 percent of supply executives reported paying the same prices as in November.

Source: ISM

Put simply, the above stories tell us that those who are involved in the day-to-day operations of business responsible for purchasing goods, that prices are rising sharply.

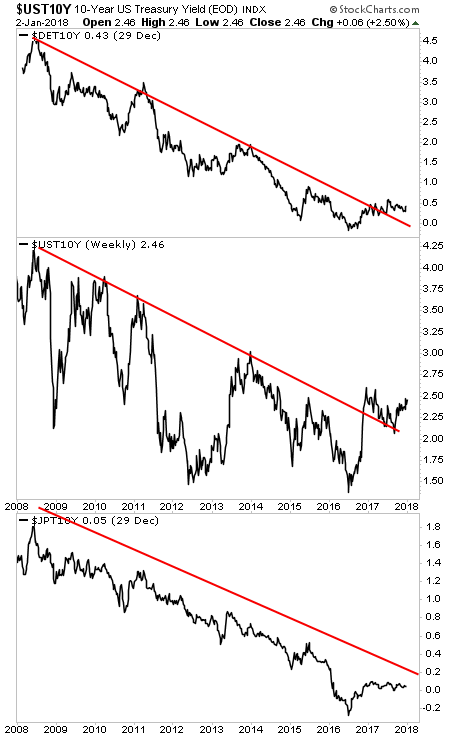

More importantly, the $44 trillion bond market is showing us that inflation is on the rise.

As I explain in my bestselling book The Everything Bubble: the Endgame For Central Bank Policy, US sovereign bonds (also called Treasuries) trade based on inflation expectations.

Put simply, when inflation spikes higher, so do Treasury bond yields.

When bond yields rise, bond prices fall.

When bond prices fall, the Bond Bubble bursts.

When the Bond Bubble bursts, the EVERYTHING bubble follows.

What’s coming will take time for this to unfold, but as I recently told clients, the time to make HUGE returns from inflation is here.

What’s coming will take time for this to unfold, but as I recently told clients, we’re currently in “late 2007” for the coming crisis. The time to prepare for this is NOW before the carnage hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s to come when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research