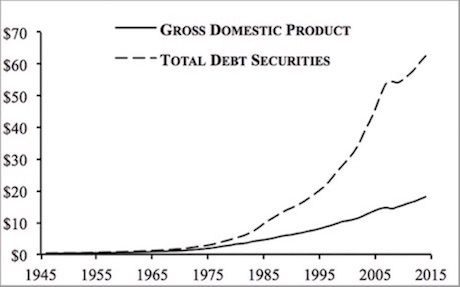

Since the late ‘90s, the US has increasingly financed its “growth” with debt.

As a result, the amount of debt in the system, relative to GDP, has skyrocketed.

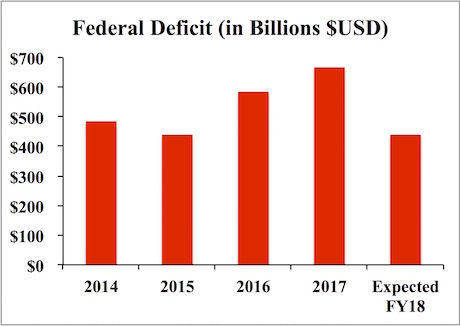

The notion that we can “grow our way” out of this is ridiculous. The US Government has brought in RECORD amount of taxes since 2014… and the Government has STILL runs $400+ Billion deficits Every. Single. Year.

Put another way, the US Government is spending an extra $400 billion every year DESPITE it bringing in a record amount of cash.

Now, the Fed claims it’s taking advantage of the current economic stability to tighten policy, but this is a joke. The Fed balance sheet has dropped only $80 billion in TWO YEARS.

And the second the credit cycle turns, the Fed will face a choice… let the system reset (as it almost did in 2008) or monetize everything.

Which option to you think it will go for?

With that in mind, there is only one course forward: printing more and more money. The outcome of this will be inflation… and not the good kind.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research