For weeks we’ve been pounding the table that the bond market was flashing “danger.” Just about everyone else on the planet was claiming, “rising rates don’t matter.”

We now know how that turned out.

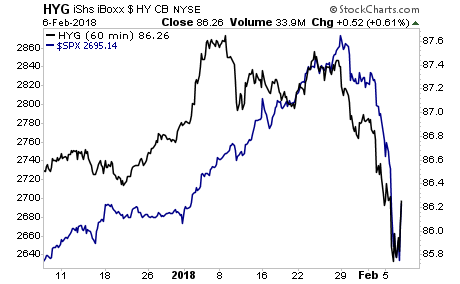

Indeed, High Yield Credit (junk bonds) peaked well before stocks did. Again, the debt markets were screaming trouble was coming. But 99% of investors were not prepared.

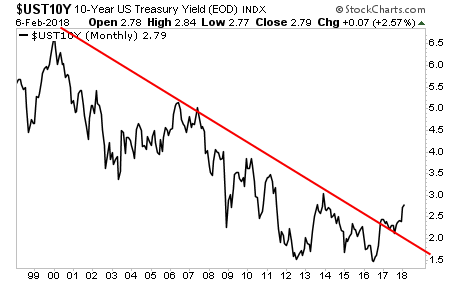

The truth is that the Fed is way behind the curve. Inflation is back and it’s endangering the bond bubble. Until the Fed or someone else reins in the bond market, there is no significant rally coming to the markets.

We need to see the yield on the 10-year Us Treasury turn back down towards its long-term trendline.

Put another way, until the bond market is back under control and yields fall, the bull market in stocks is over.

The time to prepare your portfolio is NOW before things really get ugly.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research