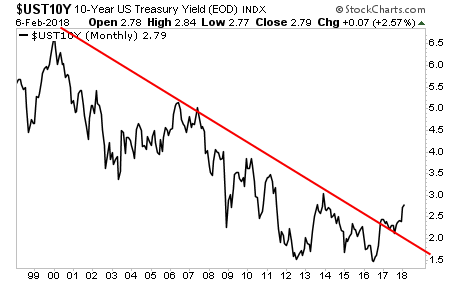

The bond market has done the Fed’s job for it.

The reality is that the Fed is way behind the curve. True, the Fed is raising rates, but it is not raising them fast enough. The market was CLEARLY in a parabolic rise based on the fact financial conditions were too loose.

So what happened?

US Treasury bonds began to collapse, pushing yields higher, which in turn forced a re-pricing of risk assets (read: stocks collapsed).

Remember, Treasury yields represent the “risk free” rate of return for the financial system, or the rate against which ALL risk assets (including stocks) are valued. So when these yields rise, it means risk is repriced DOWN.

Worse still, there is no sign that this is over yet. The S&P 500 was rejected by its former trendline yesterday (blue line) so the red line (2,550) is now in play.

Buckle up, it’s about to get nasty.

The time to prepare your portfolio is NOW before things really get ugly.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research