As I’ve been stating for weeks now, inflation is the big theme for 2018. Even the Fed’s ridiculous CPI measure is coming in higher than expected (though real inflation is now at 3%).

Why is this a big problem?

Because inflation is going to:

1) Either blow up the Everything Bubble

2) Force Central Banks to become more hawkish, thereby draining liquidity from the stock market.

As I outlined in my book The Everything Bubble: The Endgame For Central Bank Policy post-2008, the Fed created a bubble in US sovereign bonds, also called Treasuries.

And because these bonds are the bedrock for the current fiat monetary system, the “risk-free rate” of return against which all risk assets are priced, when the Fed created a bubble in them, it created a bubble in EVERYTHING (stocks, commodities, corporate bonds, real estate, etc.).

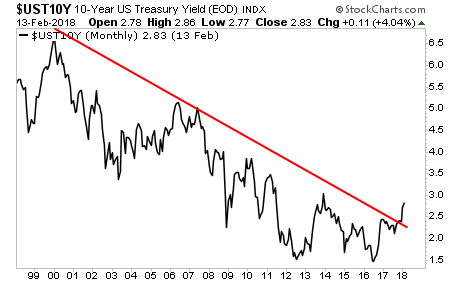

This strategy worked (as far as the Fed is concerned) provided the bond market continued to remain in a secular downtrend.

This is where inflation comes in.

Treasury yields trade based on inflation (among other things).

When inflation rises, Treasury yields rise to accommodate for this.

When Treasury yields rise, Treasury prices FALL.

When Treasury prices FALL, the Everything Bubble begins to burst.

Well guess what? Treasury yields are SOARING, having broken a 20 year downtrend.

Put simply, this chart is telling us BIG inflation is on the way. The Everything Bubble is on borrowed time unless the Fed acts soon.

The time to prepare your portfolio is NOW before things really get ugly.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research