The Fed is “letting the stock market go.”

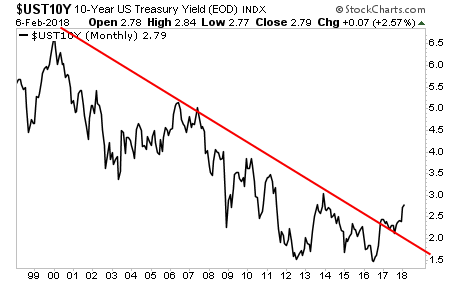

As I’ve outlined multiple times, if the Fed has to choose between supporting the bond bubble or supporting stocks, it will choose bonds Every. Single. Time.

The fact is that in a debt-saturated world such as the one we live in today, if stocks collapse, investors and Wall Street get angry. If bonds collapse, entire countries go bust.

Cue NY Fed President Bill Dudley last week:

Judging by remarks this week from policy makers, who were unmoved by rising yields and the losses in stocks, the Powell Fed isn’t rushing to signal that tendency. New York Fed President William Dudley on Thursday called the stock selloff “small potatoes” and said it has no economic implications.

Source: Bloomberg

This is Bill Dudley talking… the guy who was pushing for more QE non-stop and who routinely appeared to verbally “prop up” the markets anytime they took a nose-dive from 2008-2016.

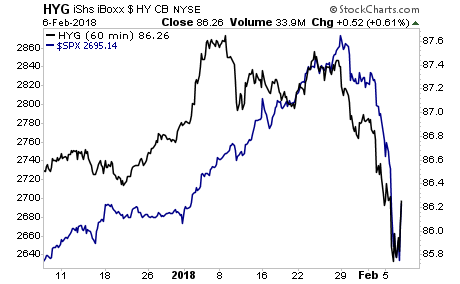

And now he’s calling last week’s sell-off “small potatoes.” And he’s ALSO saying that the Fed believes the markets could dive without impacting the economy in any significant way.

This means the bounce in stocks is on “borrowed time.” The time to prepare for the next drop is NOW before it hits.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

As I write this, there are only 33 copies left.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research