As I noted yesterday, stocks still have some life in them.

Calling the precise top of a bubble is all but impossible. This is particularly true when you have a White House that openly admits it views stocks as a “report card.”

Rarely does the one being graded have the ability to manipulate the results of his or her “report card.” In this case, the White House does.

Having said that, my current blueprint for what’s to come is as follows:

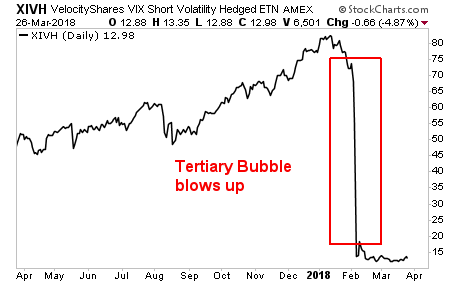

1) The Tertiary Bubbles burst (has already happened).

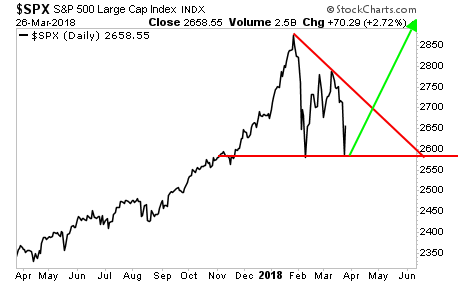

2) The Secondary Bubbles burst (coming later this year likely during the summer).

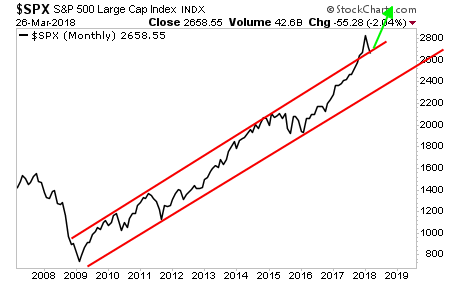

3) The Primary Bubbles burst (late 2018/ early 2019).

The Tertiary Bubbles were bubbles based on specific investing strategies in stocks (as opposed to stocks themselves). I’m talking about “shorting volatility” and “risk parity” fund strategies.

That bubble blew up in February, erasing years’ worth of gains in a matter of days.

Investors, still crazy about risk, were willing to see this as a “mulligan” and piled back into stocks (the Secondary Bubble). Given how bullish sentiment remains, I believe we’ve going to see a final push higher for a “blow off top” in stocks running into this summer.

This “blow off top” is based on the breakout above the long-term channel that has determined the stock market’s price action since the 2009 low. Investors, emboldened by this development, will push stocks to a final parabolic move higher.

At that point, THE top will be in.

If you’re looking for more investment insights as well as trade ideas, join our FREE e-letter, Gains Pains & Capital today. Swing by www.gainspainscapital.com to join today!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research