Sentiment is a strange thing.

Investors are human beings. And human beings are irrational, particularly when it comes to money related issues. The notion that the market, as a collection of irrational people, is somehow rational is ludicrous.

With that in mind, sentiment can be a powerful tool for timing market turns. If sentiment changes, but price doesn’t confirm the shift, then you know you’re near a turn.

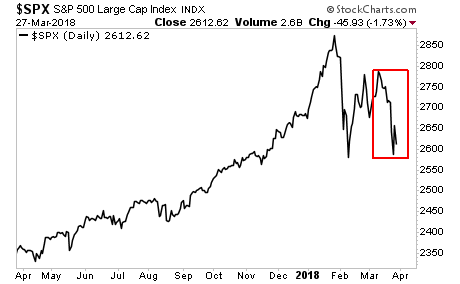

Case in point, two weeks ago I noted to Private Wealth Advisory subscribers that investors were insanely bullish despite the fact the S&P 500 was nearly 5% of its previous peak of a month ago!

At that time I noted that this indicated we were very close to a short-term TOP and that stocks would soon crater.

Fast forward a week and stocks did indeed crater, falling to retest the February lows.

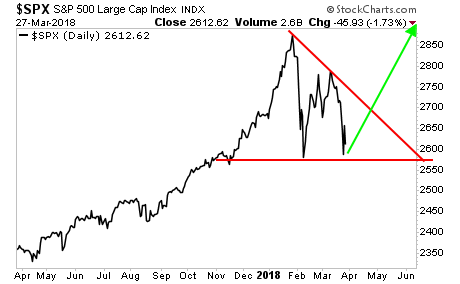

Which brings us to today. Sentiment is once again at EXTREME levels with investors 100% certain stocks are about to crash. Everywhere I look I see talk of a bear market starting.

This is happening at a time when stocks are actually HIGHER than they were in February.

Which tells me stocks are about to rally in a big way. I believe we’re about to have a final blow off top for this bull market with stocks going to new all-time highs.

At that point, THE top will be in.

If you’re looking for more investment insights as well as trade ideas, join our FREE e-letter, Gains Pains & Capital today. Swing by www.gainspainscapital.com to join today!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research