The Fed is now officially screwed.

The single biggest concern for the Fed is inflation. The reason for this is that US Treasuries are currently in a massive bubble. And those Treasury yields trade based on inflation.

If inflation rises, so do Treasury yields.

If Treasury yields rise, Treasury prices fall.

If Treasury prices fall, the bond bubble begins to burst.

Here’s the bad news… inflation is roaring. The Fed’s official inflation measure, the CPI, is now clocking in at 2.4%. And remember, this is the inflation measure that is meant to UNDERSTATE real inflation.

Elsewhere there are clear signals that inflation is over 3% (the NY Fed’s UIG) or even higher. And bear in mind, this is happening at a time when the Fed is already raising rates 3-4 times per year.

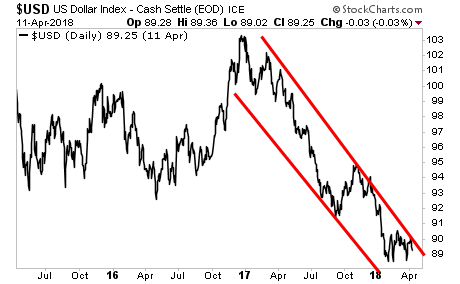

Small wonder then that the $USD is dropping like a brick.

If you’re not actively taking steps to prepare for what’s coming, you need to start NOW.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research