The financial world is finally waking up to the fact that inflation is in fact MUCH higher than previously believed.

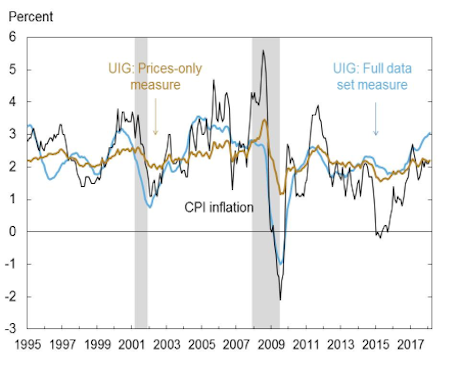

As we noted yesterday, the official measure of inflation, the CPI, is now clocking in at 2.4%, well above the Fed’s so-called target of 2%.

This is really, REALLY bad news because the CPI is actually massaged to make inflation look LOWER than it really is.

So if CPI is at 2.4%… where is REAL inflation?

Well, the NY Fed’s “in-house” inflation measures, the UIG suggests it’s actually MUCH higher at 3.14%.

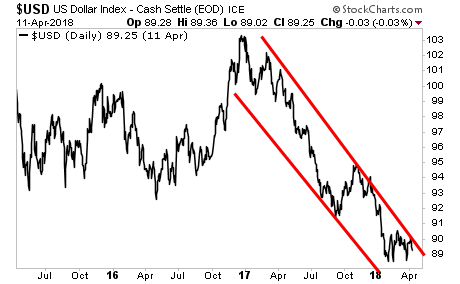

Small wonder then that the $USD is dropping like a brick.

That’s an ASTONISHING 13% drop in the last 14 months.

Let me ask you… if REAL inflation is only 2-3%… why would the US Dollar be dropping like a brick this way?

This is THE Black Swan even of 2018. And the Fed is hopelessly behind the curve on it.

If you’re not actively taking steps to prepare for what’s coming, you need to start NOW.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research