If you think what’s happening in the markets has ANYTHING to do with tariffs, you need to rethink some things. The single most important factor for the markets is…LIQUIDITY.

The Fed is pulling liquidity out of the market at its fastest pace in decades… possibly ever. What started as a $10B per month QT program has hit $30B per month and will soon be $50B per month

That comes to $600 billion per YEAR. Meaning the Fed is withdrawing Sweden’s GDP in liquidity every 12 month.

To make this worse, the Fed is ALSO hiking rates, which strengthens the $USD making debt more expensive. There is over $6T in $USD-denominated debt in the EM space. This is why this area started blowing up in March/ April when the Fed’s QT rose to $30B per month.

And, lest we not forget, the $USD is the reserve currency of the world, accounting for 86% of currency trading. So if the $USD is strengthening AND the Fed is pulling liquidity, you’re talking about 86% of ALL currency transactions becoming more expensive/ tighter.

Put simply, the Fed is going ALL OUT with is program to normalize. It’s almost as if Powell wants to undo the entire ’08-’16 period in 3-4 years. That’s insane especially when you consider that when you borrow in $USD, you are effectively SHORTING the $USD.

So that $20T in US debt.. that’s basically $20T in $USD shorts. Expand that thinking to the total amount of $USD-denominated debt in the global financial system and Powell is really playing with fire.

—————————————————————-

10 of Our Last 11 Trades Were Double Digit Winners

Our options trading system is on a HOT streak: 10 of our last 11 trades were double digit winners!

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 35% this year alone… beating the S&P 500 by an astonishing 34%.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

——————————————————————————————————-

How does this play out?

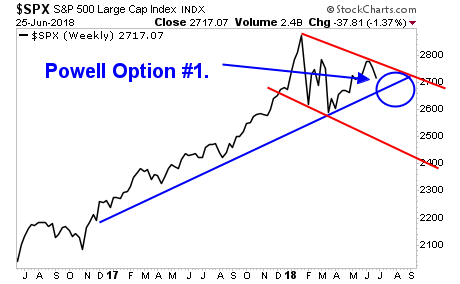

I believe Powell will back off once the carnage in the EM space spreads to the US. The last week has probably been a MAJOR wake up call for the new Fed Chair. He might very well choose to change course and walk back Fed Policy allowing the market to bottom soon.

That is “Powell Option #1” in the chart below.

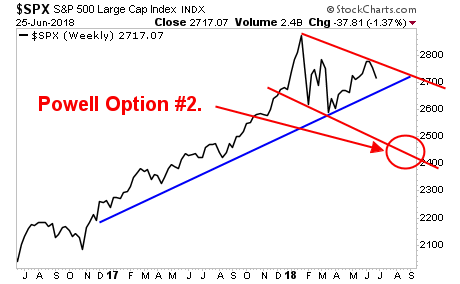

However, there is another, far more concerning option, “Powell Option #2.” In this option, Powell decides to pull a Trump-like strategy with Fed policy.

President Trump is running his Presidency like a self-owned business. Business owners will often choose to take “the hit” in the short-term to address issues that will only get worse the longer they are left. President Trump has thus far done this with NK, trade, the US economy and is now shifting to Iran & immigration.

What remains to be seen is if Powell takes this as his template… meaning, he “takes the hit” by going all out on QT/ rate hikes now, rather than letting those issues continue onwards.

That is Powell Option #2. It is a much uglier outcome for the stock market.

In the simplest of terms, does Powell CHOOSE to crash the markets now (20% drop in stocks) in the pursuit of his goal or does he go have measure and take his time. We’ll know within the next 2-3 weeks.

On that note, we are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital from when and if a stock market crash hits.

It’s called The Stock Market Crash Survival Guide… and it is available exclusively to our clients.

To pick up one of the 100 copies…use the link below.

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers