The Trump White House is currently on a collision course with the US Federal Reserve (the Fed).

First a little background.

The Trump administration has “branded” the stock market as part of its success story. President Trump himself has tweeted on the subject more than 20 times. And Secretary of the Treasury Steve Mnuchin has even stated publicly that the Trump White House views the stock market as a “report card.”

Put simply, the White House wants stocks to be as high as possible.

On the other hand, the Fed has made it clear that it will be focusing on the real economy as opposed to the financial markets. New Fed Chair Jerome Powell has emphasized this approach in multiple speeches and Q&A sessions. He has even explicitly stated that some sectors of the stock market are “overvalued” (an extraordinary statement for a Fed Chair).

With that in mind, the Fed is embarking on an AGGRESSIVE tightening schedule, having already raised interest rates SEVEN times, with an additional five hikes planned in the next 18 months.

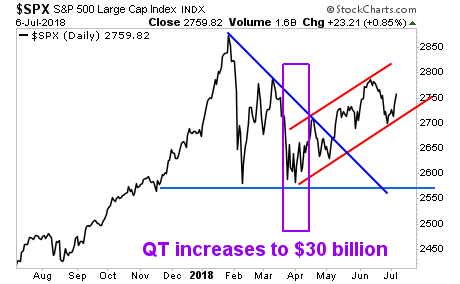

At the same time, the Fed is pursuing Quantitative Tightening (QT) in a hope to shrink its mammoth $4.4 trillion balance sheet. QT started at a pace of $10 billion per month. It increases to $30 billion per month in April. And it’s increasing to $50 billion per month this month (July)

ALL of this is VERY stock market negative.

—————————————————————-

10 of Our Last 11 Trades Were Double Digit Winners

Our options trading system is on a HOT streak: 10 of our last 11 trades were double digit winners!

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 35% this year alone… beating the S&P 500 by an astonishing 34%.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

In the short-term, President Trump’s tweets and verbal interventions from cabinet officials can induce a rally in stocks… but it is the Fed that will determine where the markets are heading. It is not coincidence that stocks peaked before QT hit $30 billion per month and have since struggled to reclaim their former highs (despite MULTIPLE efforts by Trump admin officials to “talk up the markets”).

What does this all mean?

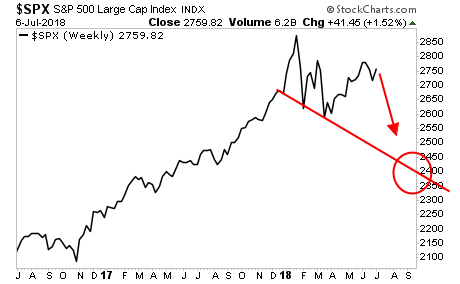

The Trump White House and the Fed are on a collision course. And truth be told, unless the Fed reverses course, stocks will drop, and drop HARD.

How hard?

The current downside target is in the 2,300-2,4500 range on the S&P 500.

The time to prepare for this is NOW before the carnage hits.

On that note, we are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital when and if a stock market crash hits.

It’s called The Stock Market Crash Survival Guide… and it is available exclusively to our clients.

To pick up one of the 100 copies…use the link below.

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research