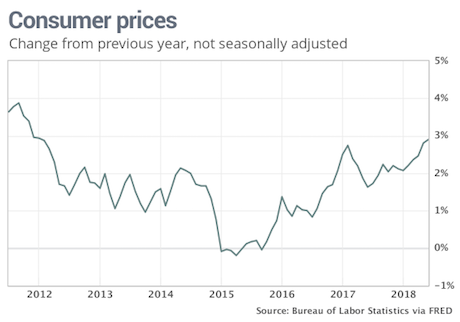

As we noted on Friday, the official inflation metric, called the Consumer Price Index (or CPI) is designed to HIDE inflation, not measure it.

Case in point, over the last two months, the CPI has relied on the collapse in prices of various non-essential items (airline tickets, hotel rooms, etc.) to “cover up” the increase in energy, housing, and the other items we all need.

And yet, even despite this “massaging” of the data, the CPI has hit 2.9%.

Put another way, inflation is running so hot right now that even with various gimmicks in place, the CPI is STILL closing in on 3%.

—————————————————————-

A Select Group of Traders Are CRUSHING the Market By 25%… With Just 1 Trade Per Week

Our options trading system is on a HOT streak: 12 of our last 14 trades were double digit winners!

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 29% this year alone… beating the S&P 500 by an astonishing 25%.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

Why is this a big deal?

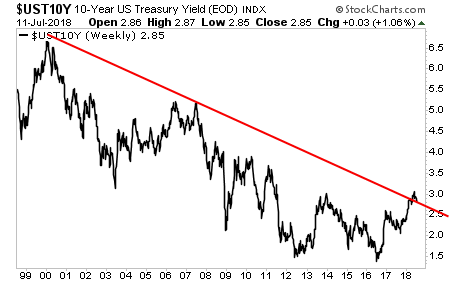

Because TREASURY bond yields trade based on inflation. If inflation is soaring higher, bond yields will also rise to accommodate this.

If bond yields RISE, bond prices DROP.

And if bond prices DROP enough, the Debt Bubble bursts.

With that in mind, consider that yields on Treasuries have broken their long-term 20-year trendline.

This is a MAJOR problem. The entire debt bubble requires interest rates to remain LOW in order for it to be maintained.

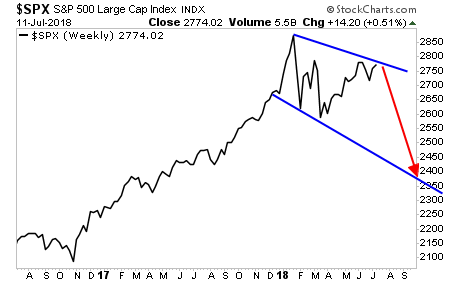

Inflation is screwing this up for the Fed… which now faces a NASTY choice… continue to support stocks or defend bonds… and unfortunately for stock investors, it’s going to have to choose bonds.

Put another way, I believe there is a significant chance the Fed will let the stock market collapse in order to drive capital BACK into the bond market to force bond yields down.

Yes, the Fed has screwed up with monetary policy. And it is doing so intentionally to try to sustain the Debt Bubble. Currently the downside target for the collapse is in the 2,300-2,450 range.

The time to prepare for this is NOW before the carnage hits.

On that note, we are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital when and if a stock market crash hits.

It’s called The Stock Market Crash Survival Guide… and it is available exclusively to our clients.

To pick up one of the 100 copies…use the link below.

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research