The single most important bond in the world is the 10-Year US Treasury bond.

This bond represents the “risk free” rate of return for a total economic cycle (roughly 10 years) denominated in the global reserve currency (the $USD).

Put simply, this is THE bond to watch if you want to keep an eye on how the financial system is acting. It is the bedrock for all risk… and its yield represents rate of return against which all risk assets are priced/ valued.

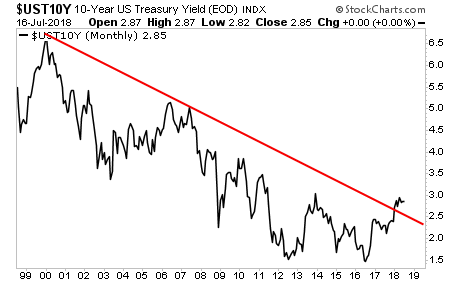

With that in mind, we need to note that the yield on the 10-Year US Treasury has broken ABOVE its long-term 20-year bull market trendline.

This is a MAJOR problem. And the Fed is going to “fix” it by crashing stocks.

—————————————————————-

A Select Group of Traders Are CRUSHING the Market By 25%… With Just 1 Trade Per Week

Our options trading system is on a HOT streak: 12 of our last 14 trades were double digit winners!

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 29% this year alone… beating the S&P 500 by an astonishing 25%.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

The US financial system has over $60 trillion in debt securities sloshing around in it. ALL of this is priced based on the assumption that bond yields will continue to fall; which is why the fact that the yield on the 10-Year US Treasury is breaking out to the upside represents a true SYSTEMIC risk.

The fact is that the Fed HAS TO act to stop the bond bubble from bursting. And it’s going to do this by crashing stocks, and driving capital into the bond market to force yields lower.

This is why the Fed continues to hike interest rates and drain liquidity from the financial system via its now $40 billion per month QT program: the Fed HAS TO get bond yields back below their trendline.

So what does this mean?

The stock market is no borrowed time. Yes, stocks can still push to the upside based on pumping a handful of Tech stocks… but the BIG picture is that the Fed is trying to crash stocks to save bonds.

The time to prepare for this is NOW before the carnage hits.

On that note, we are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital when and if a stock market crash hits.

It’s called The Stock Market Crash Survival Guide… and it is available exclusively to our clients.

To pick up one of the 100 copies…use the link below.

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research