The Powell Fed has decided to embark on an aggressive tightening schedule, with five more rates hikes while also draining an amount equal to Sweden’s GDP in liquidity over the next 18 months.

The Fed believe it can do this because the economy is strong and inflation is rising. However, it has failed to account for the impact on the financial markets/corporate sector.

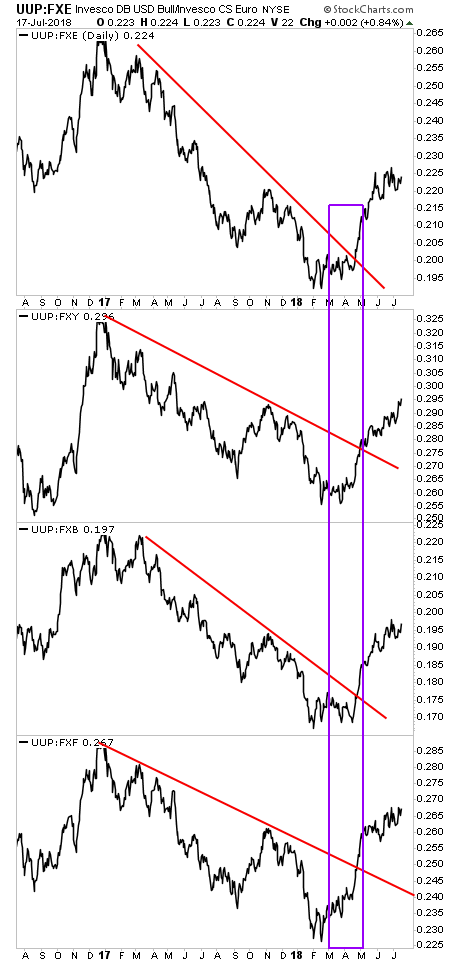

Which brings us to Exhibit A:

The $USD has broken out to the upside against all major currency pairs.

Going into 2018, the $USD was collapsing. But once the Fed’s QT program increased to $30 billion per month in April 2018, we saw a sharp the $USD erupt higher against the Euro (UUP:FXE), Japanese Yen (UUP:FXY), British Pound (UUP:FXB) and Swiss Franc (UUP: FXF). This caused the $USD to break downtrends in all major currency pairs (see purple square in chart below).

This was a gamechanger. It shifted the system towards a strong $USD trajectory.

Under normal circumstances, this would be problematic in that it would put pressure on US trade as well as hurt profit margins for corporates (44% of corporate revenues come from overseas).

However, we also have to consider the US’s debt situation today.

The US has over $20 trillion in public debt, giving it a Debt to GDP ratio of 105%. And this is growing as the US deficit swells courtesy of tax cuts, combined with President Trump’s Keynesian spending (infrastructure, and other programs). Indeed, the US plans to run a $1 TRILLION deficit in 2019.

Under these circumstances, a strong $USD is a MAJOR problem. When you borrow in $USD (issue US denominated debt) you are effectively SHORTING the $USD. Which means that with every tick higher in the $USD, it is becoming more and more difficult for the US to fund its debt expenses.

Throw in the fact that the US debt markets are beginning to drop, forcing yields higher (which again means it’s becoming more expensive for the US to finance its debt loads) and you’ve got the makings of a REAL crisis.

There is only one real solution to this: a weak $USD. Every week that the Fed waits before backtracking on its current policies is another step towards a debt crisis in the US.

We offer a FREE investment report outlining when the bubble will burst as well as what investments will pay out massive returns to investors when this happens. It’s called The Biggest Bubble of All Time (and three investment strategies to profit from it).

We made 1,000 copies to the general public.

As I write this there are fewer than 100 left.

To pick up your FREE copy…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research