Traders will shoot for new all-time highs for the S&P 500 today or tomorrow.

But first, a quick review of our calls for this year.

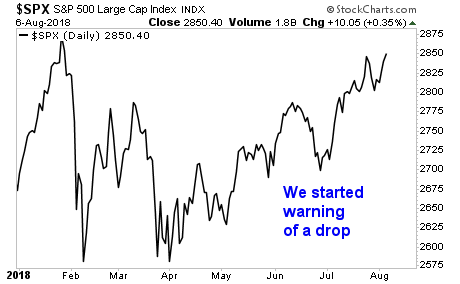

Back in mid-march, when everyone was getting bullish about stocks, we warned that the S&P 500 would revisit the lows.

Then, in late March/ early April that we believed the stock market would make a run to new all-time highs this summer. Thus far the Russell 2000 and the NASDAQ have already accomplished this. The S&P 500 is now less than 30 points from doing the same.

However, since June the risk/reward profile flipped for us, and we started warning of a potentially sharp move lower in stocks.

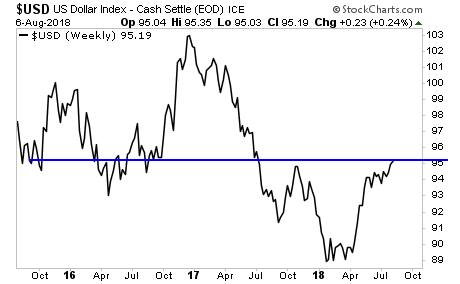

The issue for us pertains to Fed policy. The Fed is far too aggressive right now, particularly when you compare what it’s doing to what the ECB and BoJ are doing. Companies are already warning of the damage the $USD’s strength is having on future results. And as we know, stocks are a discounting mechanism.

Which is why we remain concerned of a potentially aggressive sell-off in US stocks. We are NOT calling for a crash, but the odds heavily favor a sharp move lower, rather than an explosive rally at this point.

So while new ATHs are coming, the real opportunity lies on the other side.

Those who are allocating capital based on this… could stand to make a FORTUNE as it unfolds.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 200 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research