Why the $USD is about to collapse.

The Fed left rates unchanged last week, upgrading its view on the economy from “stable” to “strong.” It also reiterated its plans to raise rates two more times in 2018.

Put simply, this was a notably hawkish Fed meeting. Which is why it’s striking that the $USD didn’t do much of anything in response. The greenback was effectively flat that day.

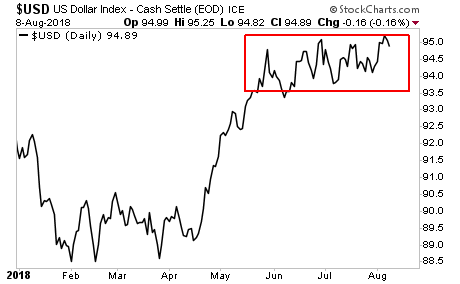

Truth be told, the $USD hasn’t done much of anything since the Fed June meeting. Again, this is striking because the Fed is currently engaged in the single most hawkish monetary policy in history with 3-4 intended rate hikes per year and a QT program of $30 billion per month.

And yet, the $USD has traded sideways since mid-June.

Let’s be honest here, if the $USD cannot mount a major bull rally when the Fed is this hawkish (and other Central Banks are maintaining NIRP and QE programs), then the $USD is in SERIOUS trouble.

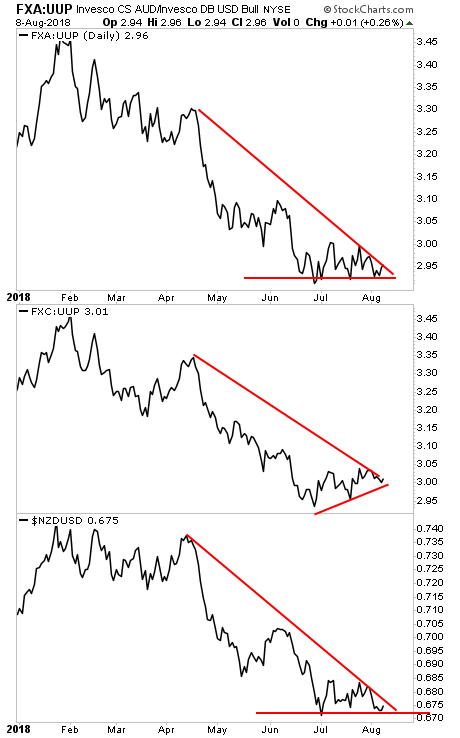

The picture worsens for the $USD when you start including currency pairs.

The Australian Dollar: $USD pair, the Canada Dollar: $USD pair, and the New Zealand Dollar: $USD pair are all bottoming right now. This is a MAJOR signal that the $USD is turn sharply down.

So, we’ve got the $USD failing to breakout to the upside despite the Fed running the most aggressively hawkish monetary policy in history… as well as the three most significant inflationary currency pairs signaling pronounced $USD weakness is about to hit.

That’s a heck of a “tell” from the markets. And it’s “telling” us that we’re about to see a major inflationary move.

We just published a Special Investment Report concerning a FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm

We are making just 99 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research