As we noted yesterday, the global financial system is beginning to experience its first taste of “contagion” risk in years.

US stocks remains clueless to this… but it’s doubtful that will continue

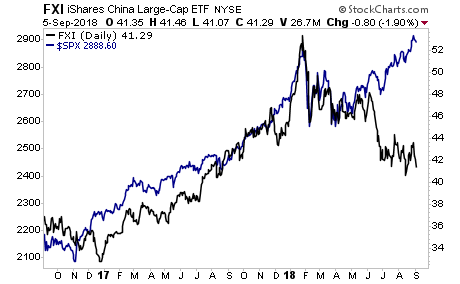

China (black line in chart below) has imploded and is in a full-blown bear market. The odds that the US stock market (blue line in charts below) can avoid what’s affecting China are low.

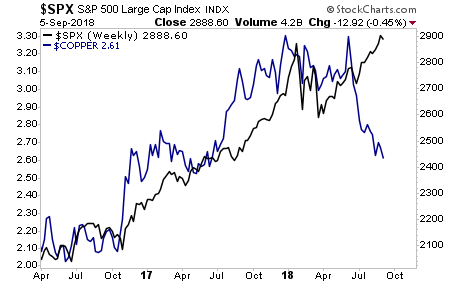

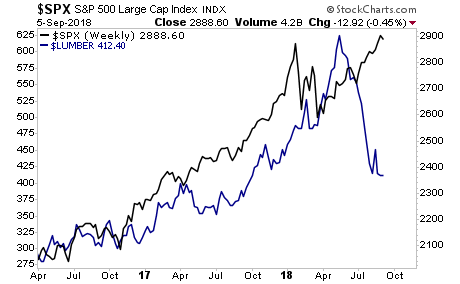

This is not just a stock story either, this is a GROWTH story. Both Lumber and Copper (two of the most economically sensitive commodities) have collapsed. Here again, the US stock market is clueless. Will it continue?

Copper vs. the S&P 500:

Lumber vs. the S&P 500:

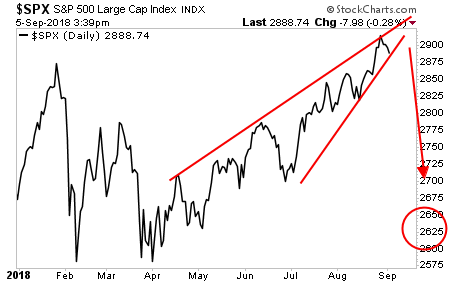

If you think this can’t spread to the US, think again. The market has is about to test the downside of a rising wedge pattern. A break here targets the mid 2600s.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 56 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research