Something has changed in the market.

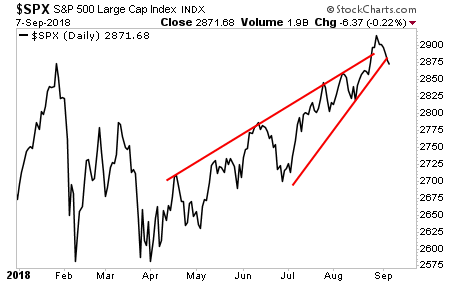

The momentum-driven rally that pushed stocks to new all-time highs completely floundered a few weeks ago. What should have been a monster breakout on massive buying power ended up being a feeble push to new highs before stocks promptly rolled over.

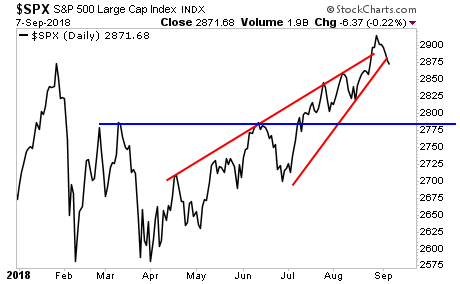

More and more, that is looking like a false breakout. This opens the door to a SHARP correction downwards. The first major line of support is just below 2,800 at 2,780.

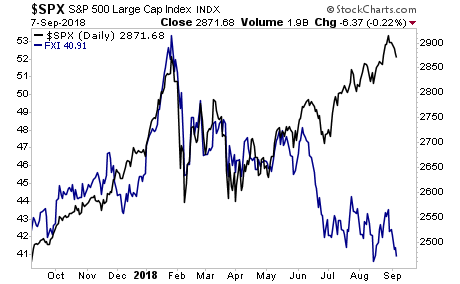

That is the GOOD outcome. The BAD one is if US stocks finally get contaminated with what the rest of the world is currently facing= a full-scale meltdown. If the US goes the same route as China, the Emerging Markets, industrial metals, and other growth-related asset classes, the S&P 500 could easily collapse to sub-2,600.

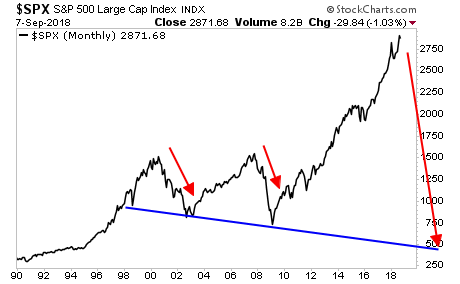

That’s the pretty bad outcome. The REALLY bad one is that the Everything Bubble bursts and we swiftly move into a crisis that makes 2008 seem like a picnic.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 56 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research