Few asset classes have been bas badly bruised up as Gold this year. Sentiment regarding the precious metal is as bad as it was at the 2008 lows.

However, a lot of VERY positive developments have been taking place in the Gold charts.

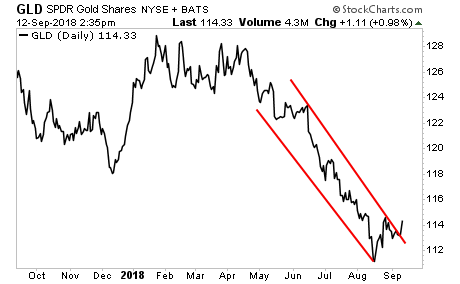

The precious metal has broken out of its downward channel running back to May.

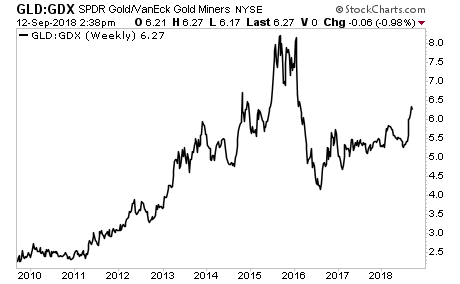

Moreover, the precious metal has begun to outperform Gold Miners. This price action is reminiscent of the last bull market run for Gold from 2011-2015.

What if this whole collapse was a false breakdown?

It’s still early, but if this WAS a false breakdown, the coming rally will be truly violent (think at least 150 on the chart above). We believe this could very well be the case as the Fed begins to walk back its hawkishness, allowing the overhead pressure to come off of Gold.

For more investment insights, join us at www.gainspainscapital.com

Best regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

ps. If you’re looking for a means of playing a Gold rally with some extra juice, we’ve discovered a “backdoor” play on the precious metal that allows you to purchase it at a discounted rate of $273 per ounce. You can pick up a copy of our detailed investment report outlining this opportunity and two others at:

https://phoenixcapitalmarketing.com/evergreen3reports.html