As if we didn’t have enough reasons to be concerned about stocks already, the bond market is blowing up again.

Why does this matter?

Because the entire move in the financial markets since 2008 has been based on Central Banks cornering the bond market. In the simplest of terms, Central Banks dealt with the crash in one major asset class (housing) by creating a bubble in another even more senior asset class (government bonds).

Because these bonds are the backbone of the current financial system, (the senior-most asset class), when they went into a bubble, everything followed.

Which is why the sudden rise in bond yields is a MAJOR problem.

If bond yields rise, bond prices fall.

If bond prices fall, the bond bubble begins to burst.

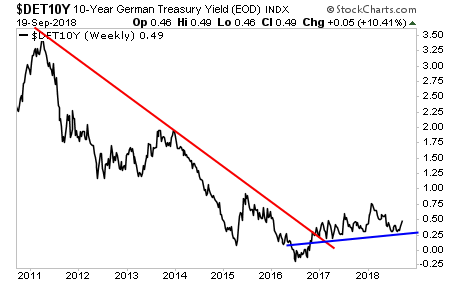

Germany’s 10-Year Government Bond Yields:

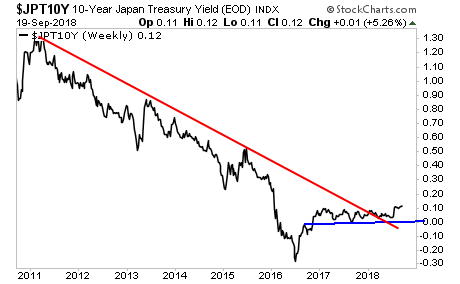

Japan’s 10-Year Government Bond Yields:

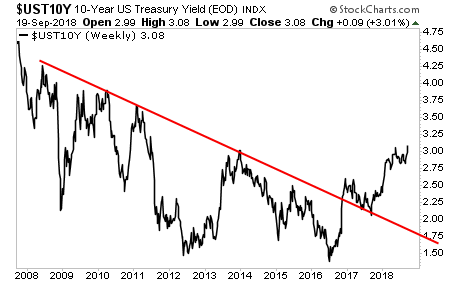

And worst of all, the US’s 10-Year Government Bond Yields:

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research