Yesterday, the Federal Reserve stated it would no longer be “accommodative” with its monetary policy.

On that same day Fed chair Jerome Powell stated that stock market valuations were in the “upper reaches of historic ranges” i.e. bubbly.

And most importantly, the Fed stated it would likely hike rates again in 2018… with another three rate hikes in 2019. If each rate hike were for 0.25%, the Fed is targeting an interest rate of 3.25% before it’s done.

Why is the Fed acting so aggressively? Remember, both the Bank of Japan and the European Central Bank are running NEGATIVE interest rates while also engaging in Quantitative Easing policies.

Meanwhile, the Fed is planning a total of 12 rate hikes before it’s finished… while engaging in a Quantitative Tightening program that would drain an amount equal to Sweden’s GDP from its balance sheet every single year.

Why is this?

Because the Fed is trying to get the bond market under control.

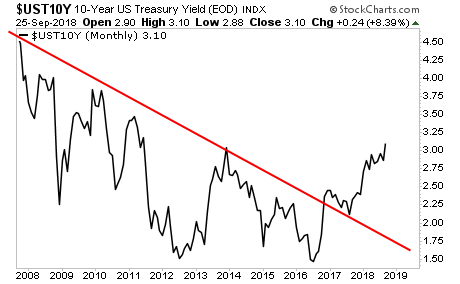

In chart form, the Fed’s primary concern is this…

The yield on the 10-Year Treasury bond, the single most important bond in the world, has broken a multi-decade downtrend. If this does not reverse soon it means the 30+ year bull market in bonds is OVER.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week. In fact we just closed a 15% gain last week. And we only held it 24 hours!

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

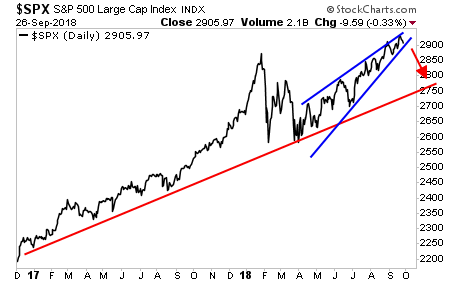

That is a MUCH bigger deal for the Fed than this…

Yes, stocks get the attention because they are more volatile, but it is the BOND BUBBLE, AKA the Everything Bubble, that is Fed’s primary concern.

If stocks drop, investors lose money… if bonds drops, entire countries go broke.

Which is why the Fed is engaging in its most aggressive rate hike cycle in history. It NEEDS to get bond yields back below their long-term trendline one way or another. And if collapsing stocks to force capital into bonds is the way it has to be… so be it.

Again, this is a MASSIVE deal. And while 99% of investors are focusing on stocks… it is BONDS that are flashing a major warning.

The whole situation is getting eerily similar to late 2007. And now, like then, the vast majority of investors have no clue how to invest during the coming crisis . Which is why smart investors who put capital to work here stand to make LITERAL fortunes.

We offer a FREE investment report outlining when the bubble will burst as well as what investments will pay out massive returns to investors when this happens. It’s called The Biggest Bubble of All Time (and three investment strategies to profit from it).

We made 100 copies to the general public.

As I write this there are only a handful left.

To pick up your FREE copy…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research