The financial markets are now rapidly running out of liquidity.

The Fed will withdraw $50 billion in liquidity from the financial system this month via its Quantitative Tightening, QT, program. This is the largest liquidity withdrawal since the 2008 crisis.

The Fed is not the only one.

The ECB will halve its QE program to just €15 billion per month: its smallest liquidity pump since it initiated its QE program in January 2015.

And finally, the Bank of Japan, is ALSO halving its QE program for long duration bonds this month.

Put simply, the three most important Central Banks are either actively withdrawing liquidity from the system (the Fed) or rapidly cutting their liquidity pumps (the ECB and BoJ).

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week. In fact we just closed a 15% gain last week. And we only held it 24 hours!

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

October will mark the lowest amount of Central Bank liquidity hitting the system in nearly FIVE years.

Small wonder then that the bond market is starting to blow up, as the single largest buyer of sovereign bonds (Central Banks) shift from net buyers to net SELLERS of debt.

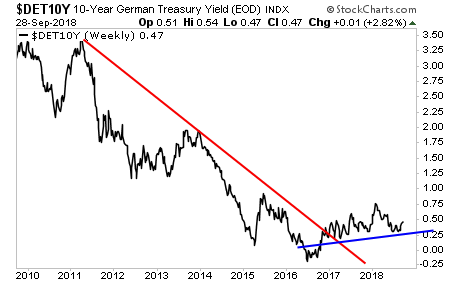

Yields on Germany’s 10-Year Bunds are breaking out.

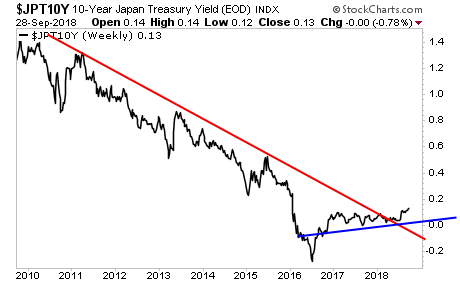

So are yields on Japan’s 10-Year Government bonds.

And worst of all, yields on the all-important 10-Year US Treasury bond are breaking their multi-decade downtrend.

Again, this is a MASSIVE deal. And while 99% of investors are focusing on stocks… it is BONDS that are flashing a major warning.

The whole situation is getting eerily similar to late 2007. And now, like then, the vast majority of investors have no clue how to invest during the coming crisis . Which is why smart investors who put capital to work here stand to make LITERAL fortunes.

We offer a FREE investment report outlining when the bubble will burst as well as what investments will pay out massive returns to investors when this happens. It’s called The Biggest Bubble of All Time (and three investment strategies to profit from it).

We made 100 copies to the general public.

As I write this there are only a handful left.

To pick up your FREE copy…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research