The Everything Bubble is bursting.

After the 2008 Crisis, global central banks created a bubble in the sovereign bond market via ZIRP and QE. Because these bonds are the bedrock of our current financial system, when Central Banks created a bubble in this asset class, they were effectively creating bubbles in EVERYTHING.

That bubble is now bursting.

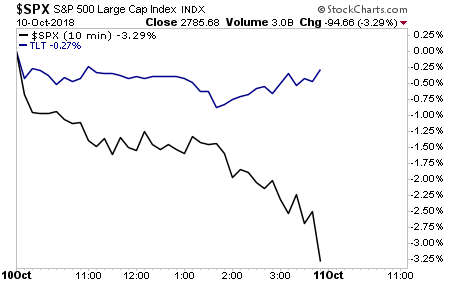

Historically, when stocks collapse as they did yesterday, the bond market rallies. Not yesterday. Both stocks AND bonds finished the day DOWN.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week. In fact we just closed a 15% gain last week. And we only held it 24 hours!

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

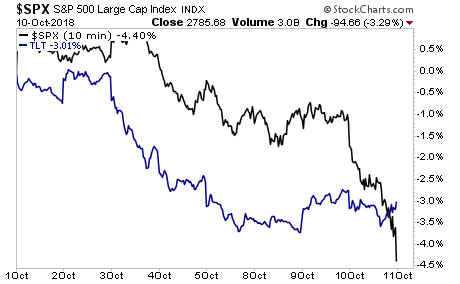

Unfortunately, yesterday was not an anomaly. Both bonds and stocks are DOWN for the month for October thus far.

This signals a tectonic shift. Throughout the post-2008 era, anytime stocks collapsed, money rushed into bonds.

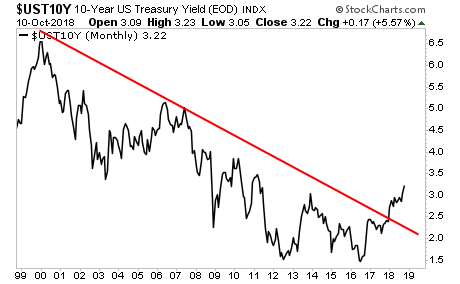

Not anymore. Indeed, the bond market is now collapsing ALONG with stocks. The yield on the most important bond in the world, the 10-Year US Treasury, has broken its multi-decade trendline.

If you aren’t actively taking steps to prepare for this, you need to start NOW.

On that note, we offer a FREE investment report outlining when the bubble will burst as well as what investments will pay out massive returns to investors when this happens. It’s called The Biggest Bubble of All Time (and three investment strategies to profit from it).

We made 100 copies to the general public.

As I write this there are only a handful left.

To pick up your FREE copy…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research