The bounce is now ending.

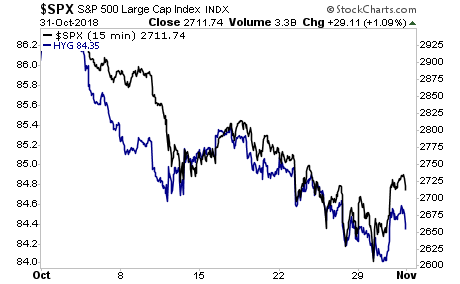

Credit has been leading stocks during this recent bout of volatility. Credit isn’t “buying into” this bounce at all, having already broken back down into the gap up from yesterday’s rally.

By the way, in October, Junk Bonds posted their worst monthly return since the depth of the 2008 crises. That should give you an idea of the environment we’re in right now.

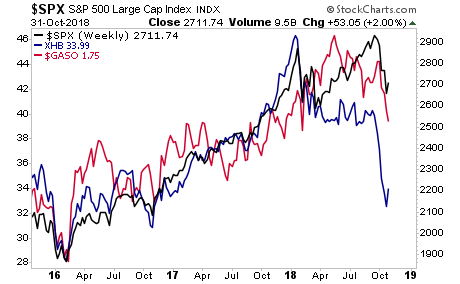

Indeed, when you consider what Housing and Gasoline are suggesting about the economy, it becomes clear stocks have a LONG ways to catch up on the downside. Gasoline suggests the S&P 500 should be in the 2,500s… Housing is down in the 2,200s.

Bottomline: we are officially in a bear market, and stocks are going to collapse in a BIG way.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

We are giving away just 100 copies for FREE to the public.

Today there are just a handful left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research