Today voters in the United States will decide which political party controls Congress.

From the perspective of the financial markets, it doesn’t matter.

Regardless of whether Congress is controlled by Democrats or Republicans, the bull market in stocks is OVER. Yes we might get a bit of a rally based on the market digesting tonight’s results, but THE TOP is in for stocks.

That’s actually the good news. The BAD NEWS is that the US financial system might enter a crisis in 2019.

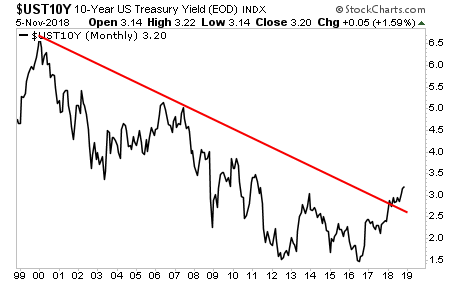

The bond market continues to blow up with yields on the ALL-IMPORTANT 10-Year US Treasury retesting their recent highs. Bear in mind, this is happening at a time when the US is planning a $1.3 TRILLION deficit next year and will be relying HEAVILY on the debt markets to fund this.

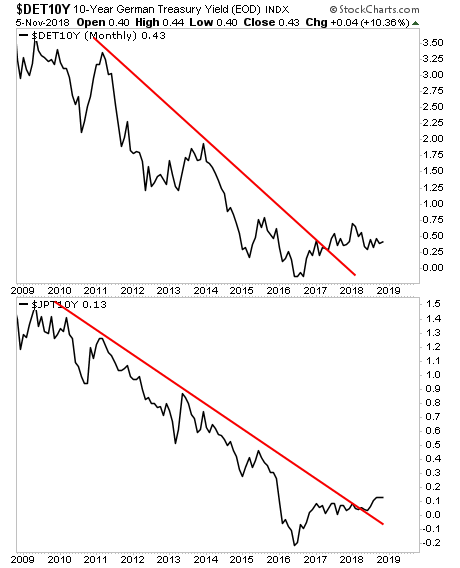

By the way, this is a global phenomenon with bond yields breaking out in Germany and Japan as well.

This is a MASSIVE deal. This is effectively the bond markets telling entire countries that if they want to issue debt, it’s going to cost them more.

And this is happening PRECISELY when these very same countries are planning on both issuing AND rolling over ENORMOUS amounts of debt.

Again… 2019 will be when the next crisis hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research