The markets are about to enter liquidation mode.

The Fed has made it clear that the only market event that would force it to stop hiking rates would be a collapse so massive that it impacts consumer spending. This means a 2008-type event.

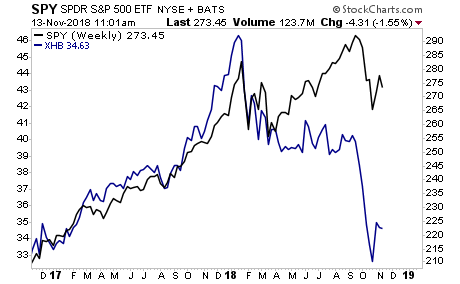

By the look of things, we’re on our way towards that. The single largest financial transaction for most Americans is the purchase of a home. With that in mind, consider what the homebuilder industry is telling us about consumer appetite.

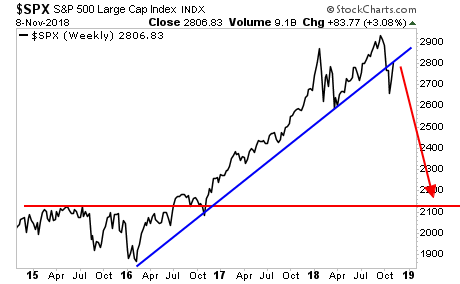

If you’re looking for a sign of what’s to come for the overall market. This is it. The stage is not set for a bloodbath as stocks meltdown to 2,100.

If you want a template for where we are right now, it’s “late 2007″… which means 2019 will be when the next crisis hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research