This might be the single most important series of articles I’ve written all year.

If you have family or friends who are concerned about the markets, forward them these emails.

The global economy is now facing the Perfect Storm. Many are confused by this because neither the economic data nor the media are presenting a picture that is anywhere near as negative as reality.

The reasons for this are that economic data is BACKWARD looking, not predictive… and the media has a vested interest in promoting a rosy picture (their advertising dollars are closely linked to economic growth/ improvement).

Financial markets, on the other hand, are FORWARD looking. And they tend to reflect reality better than most things, especially when the financial system is entering a profound change like we are today.

So what is The Perfect Storm?

Today we’re discussing China.

According to the media, China is the next superpower. We are told incessantly that China owns more of our debt than any other country. Moreover, we are told that China buying up the rest of the world or cutting trade deals that will destroy the $USD.

In reality, the Chinese financial system is teetering on the brink of collapse. The country issues $30 in debt for every $1 in GDP growth.

The debt was taken on by entities that will never pay it back (the country’s BAD loan to GDP ratio is north fo 80%)… and the debt is, for the most part, backed by nothing: time and again, we find that when it comes to collect collateral on a debt transaction in China, there is no collateral.

Imagine a mansion that looks pristine on the outside but is completely rotten inside, with the floors collapsing, mold on the walls, etc. Now imagine that the owner used a fake ID to buy the home and there is no means of finding him or her. Moreover, his or her bank account linked to the home is closed.

That is China today.

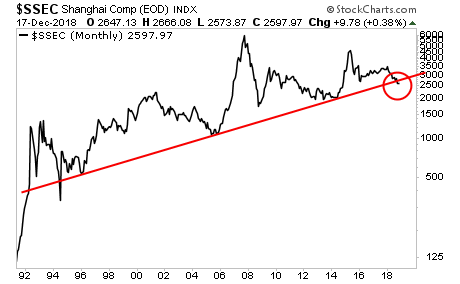

The markets know it too… which is why the Chinese stock market has broken its bull market trendline running back to… 1991.

The China Miracle is over.

Guess what’s coming next?

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research