This week is options expiration week… Wall Street’s favorite time to ramp the markets in order to insure the maximum number of options contracts expire worthless.

THIS, nothing else, is why the markets rallied this week. Tweets from the President or some statement by a Fed official were simply the excuse Wall Street used to engage in this game.

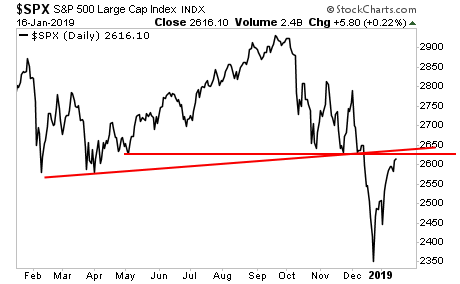

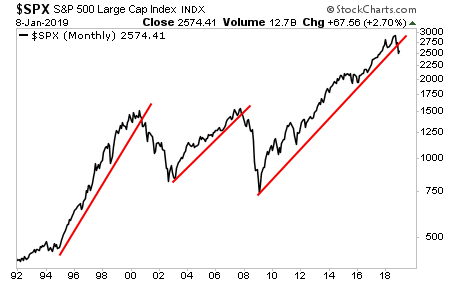

And that game is now ending. Stocks face TREMENDOUS overhead resistance here.

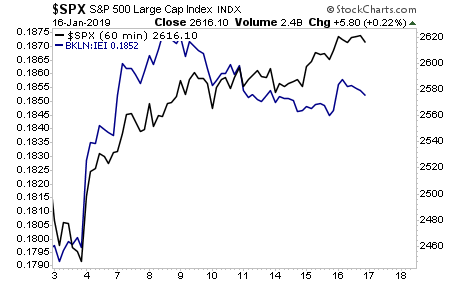

The debt markets have already figured this out and are moving into “risk off” mode.

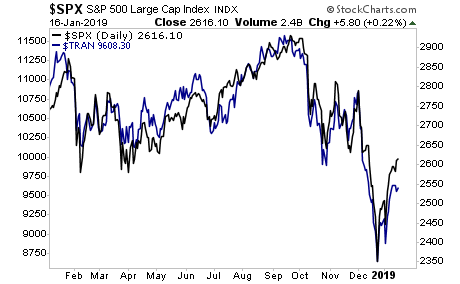

So have Transports.

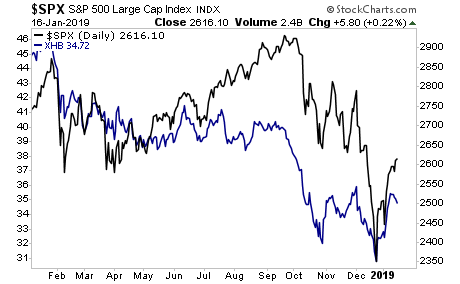

And Homebuilders.

You can ignore those internals all you like, but what has actually changed since the end of December? Is the Fed going to start loosening monetary policy? Is the economy suddenly going to start roaring again? Are earnings going to reverse and stop declining?

Or are we actually at the end of the credit cycle and moving into the next crisis shortly?

A Crash is coming… and 99% of investors will panic when it hits… but not those who have downloaded our 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on last week’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research