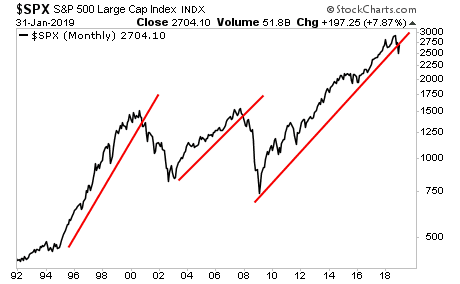

Stocks are on borrowed time.

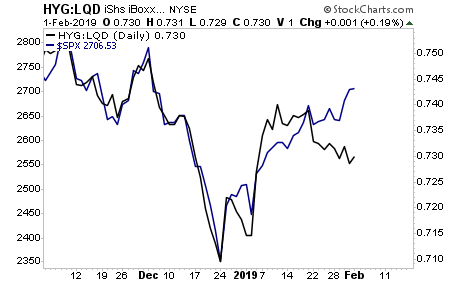

Credit leads stocks and the credit markets have already signaled the next leg down is coming.

While the S&P 500 made a final thrust higher, the High Yield: Investment Grade ratio broke down.

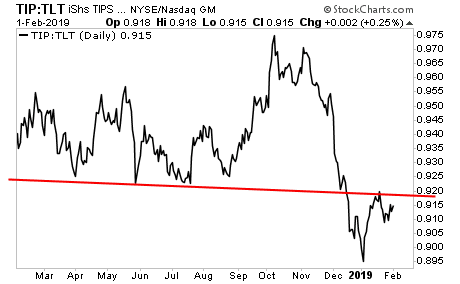

Similarly the TIP:TLT ratio which serves as a gauge for inflation vs. deflation, was rejected at overhead resistance. This tells us that the next round of deflation is coming.

Meanwhile, corporations are lowering forward guidance at an alarming rate. Caterpillar, Amazon, Apple, Samsung, LG, Fed Ex, Johnson & Johnson, Nautilus, Tesla, Tailored Brands, Signet Jewelers, Delta, Skyworks, Macy’s, Kohl’s, and American Airlines have all lowered forward guidance in the last month.

By the way, the estimates that many of these companies are missing were LOWERED just 30 days ago… so things have worsened since then!

What does management at these companies see that we don’t?

The BIG PICTURE.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research