The next leg down is officially here.

The big picture story for the markets is that the US/China trade deal is no longer important. Even if the two nations did agree on a perfect deal that resolves the structural issues between their economies (highly improbable), the fact is that the global credit cycle has turned and we are entering a contraction/ crisis.

Europe is now officially weakening with most major economies (Germany, France, Italy and Spain) approaching, if not already in, recessions.

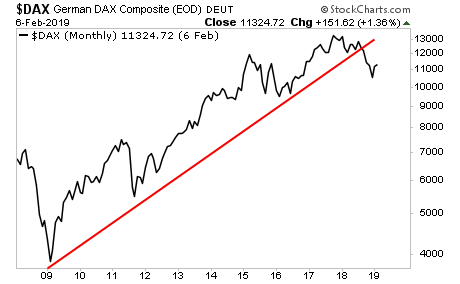

The market is fully aware of this. The German DAX has ended its bull market from the 2009 low. This latest rally is a pathetic dead cat bounce in the context of a larger bear market.

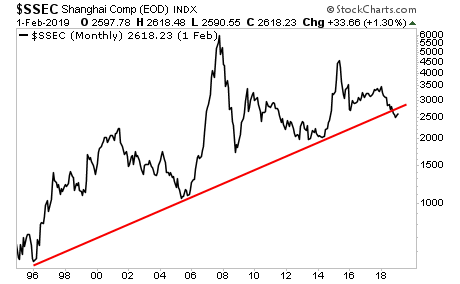

The situation is even worse in China. There we have the beginning of complete systemic collapse as the largest pile of garbage debt/ financial fraud finally blows up. China spends $25 in debt for every $1 in GDP growth. And its economy is growing, at best, by 2% per year.

The market similarly knows this which is why China has broken in 20+ year bull market trendline. The Chinese stock market has been in a series of successive bubbles followed by spectacular crashes for the last two decades. This time around, the Crash will be something truly astonishing to behold.

This leaves the US, where despite all the fanfare, the economy is almost certainly contracting if not already in a full-blown recession.

Maxing out your credit card is very different from getting a raise. What’s happened in the US in the last two years is the country maxing out its credit card on a personal, state, and national level.

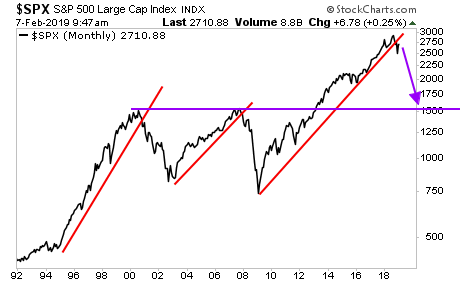

Here again the market knows this, which is why we’ve broken the bull market trendline from the 2009 lows. The ultimate downside for this collapse is at best 2,000, and more likely than not we’ll go to the high 1,000s (think 1,750-1,800).

A Crash is coming…

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research