The next leg down is just around the corner.

The markets have been warning of this for some time (as I’ve noted in recent weeks) but the move finally appears to have arrived.

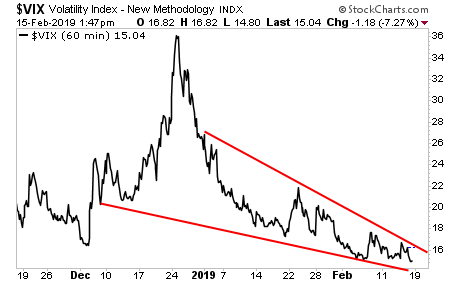

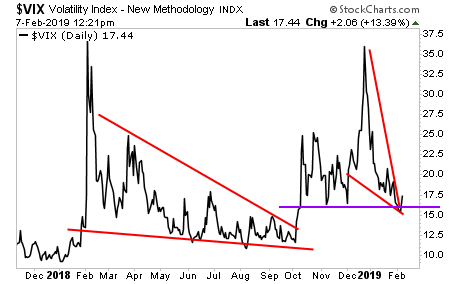

The VIX collapse that accompanied the rally in risk assets starting December 24 2018 is about to end; the VIX is coiling tighter and tighter in a bullish falling wedge formation.

The coming breakout will be truly spectacular.

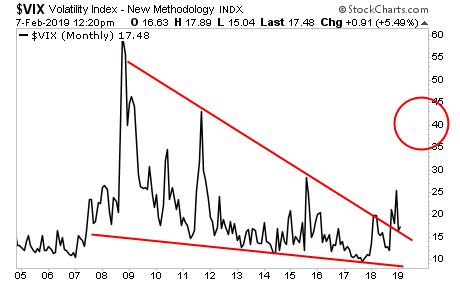

Moreover, this breakout is starting at a higher level than the one that was triggered by the 2018 collapse in the Short Volatility trade. From a technical analysis perspective, you would call this a higher low. This suggests that the VIX will soon spike even higher than it did in 2018.

Indeed, the long-term monthly chart of the VIX suggests a move to AT LEAST 40.

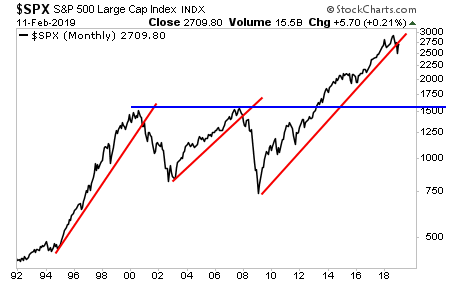

For stocks this will mean a retest of the recent lows, possibly something worse.

And deep down, the market knows it.

A Crash is coming…

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on this week’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research