Ignore the political theater.

Despite all the political divisive, the fact is that the US political elite are really interested in just one thing…

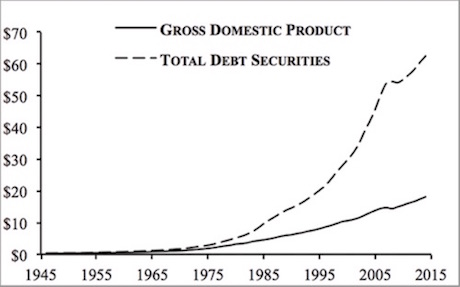

It’s this chart.

This is a chart showing the total debt in the US relative to its GDP. For the political class, the top line represents the ability to spend, while the bottom line represents what can be taxed.

The problem here is obvious… the spending is far outpacing what can be taxed. Which means, the political class will need to come up with new, innovative means of getting access to capital.

This will include wealth taxes, cash grabs, and more.

Consider the following:

- The IMF has already called for a wealth tax of 10% on NET WEALTH.

- More than one Presidential candidate for the 2020 US Presidential Race has already openly called for a wealth tax in the US.

- Polls suggest that the majority of Americans support a wealth tax.

And if you think this will stop with the super wealthy, you’re mistaken. You could tax 100% of the wealth of the top 1% and it would finance the US deficit for less than six months.

Which means…

Cash grabs, wealth taxes, and more will soon be coming to Main Street America.

Indeed, we’ve uncovered a secret document outlining how the Fed plans to both seize and STEAL savings during the next crisis/ recession.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

You can pick up a FREE copy at:

http://phoenixcapitalmarketing.com/GWG.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research