The Fed just confirmed what I have been claiming for years… that the financial system is now in an Everything Bubble, which the Fed will NOT be able to normalize.

In the aftermath of the 2008 crisis, the Fed attempted to create a bubble in the US Treasury market via Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QE) programs.

The reason is simple: Treasury yields represent the “risk free” rate of return for the entire financial system. So if the Fed can create a bubble in Treasuries, forcing yields to extraordinary lows, the entire financial system will adjust to this, resulting in all risk assets (literally EVERYTHING) going into a bubble (hence the term “the Everything Bubble”).

The problem this of course is once it has done this, the Fed will NEVER be able to normalize interest rates because the entire financial system is now addicted to extraordinarily low rates.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week. In fact we just closed a 12% gain last week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

Yesterday Dallas Fed President Robert Kaplan confirmed this in an article…

U.S. nonfinancial corporate debt as a percentage of GDP is now higher than the prior peak reached at the end of 2008…Nonfinancial corporate bonds outstanding in the U.S. grew from approximately $2.2 trillion in 2008 to approximately $5.7 trillion at year-end 2018…

Source: The Dallas Fed

Kaplan is here admitting that the US corporate space is now MORE leveraged to the real economy than it was in 2008. As a result of this…

An elevated level of corporate debt, along with the high level of U.S. government debt, is likely to mean that the U.S. economy is much more interest rate sensitive than it has been historically.

Source: The Dallas Fed

Even more astonishing Kaplan stated that THIS was the reason why the Fed has decided to stop hiking interest rates!

Again, a Fed President stated point blank that the Fed is aware that the entire US financial system is one gigantic leveraged bet on low interest rates… and as a result of this, the Fed is DONE with normalization.

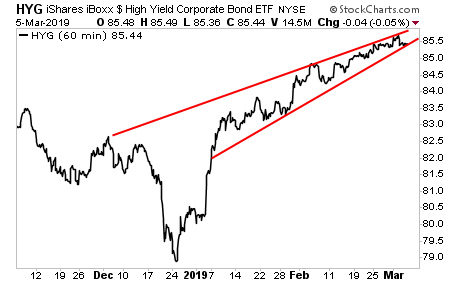

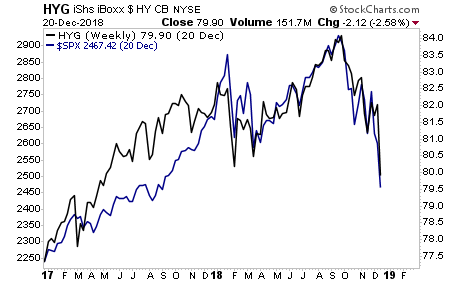

Unfortunately for the Fed, the bond market is breaking down again. Junk Bonds, the riskiest sector of the corporate bond market, is about to break its rising wedge formation.

This is telling us that the next leg down is about to hit. If you’ll recall it was Junk Bonds that peaked first and then lead stocks to the downside during the October-December meltdown in 2018.

If you aren’t actively taking steps to prepare for this, you need to start NOW.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research