So it was all BS.

For months now, the Trump administration, through both tweets from the President and countless articles published in the financial media, has proclaimed that a trade deal between the US and China was “just around the corner.”

Every single time these stories/ tweets hit the newswires, stocks have rallied on the news. Every. Single. Time.

And it was all complete BS.

How do I know this? Because Bloomberg just unintentionally revealed it more than halfway down an article concerning a possible meeting between President Trump and Premiere Xi of China.

Lighthizer this week pointed to “major issues” still unresolved in the talks, with few signs of a breakthrough on the most difficult subjects. Chinese officials have also bristled at the appearance of the deal being one-sided, and are wary of the risk of Trump walking away even if Xi were to travel to the U.S.

Source: Bloomberg (H/T Bill King)

Without an agreement on “the most difficult subjects” (i.e. IP theft, enforcement of violations) there is NO trade agreement. End of story.

—————————–

This Might Be the Single Best Options Trading System in the Planet

Since inception in 2015, this trading system has produced average annual gains of 41%.

I’m not talking about a single trade… I’m talking gains of 41% per year on the ENTIRE portfolio.

We’re on another winning streak, having closed out a 9%, 12% and another 12% gain in the last four days alone.

With this kind of track record, we’re closing the doors to new subscribers soon.

There are currently fewer than 10 slots left for potential subscribers.

To lock in one of the last slots…

So all the talk of progress… all the talk of being “close to a deal” was total BS used to juice stocks higher.

And the worst part is it has suckered in Mom and Pop investors like sheep to the slaughter.

The latest fund inflow data reveals investors plowed over $27 BILLION into US stock funds and ETFs in the week ended March 13th2019. This is an all-time record.

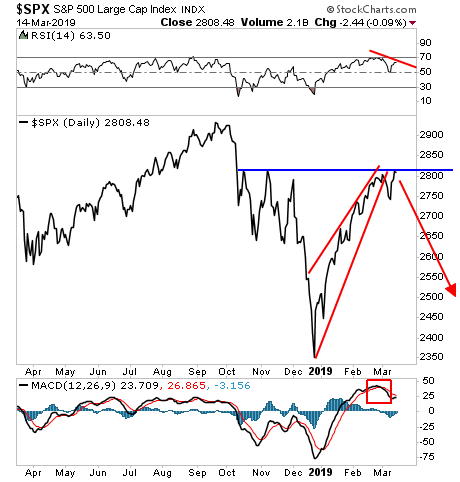

Worst of all, they are buying right as stocks slam into resistance, failing to score a breakout (despite countless trader games). Momentum is gone here with MACD on a “Sell” signal. We also have negative divergence on the RSI.

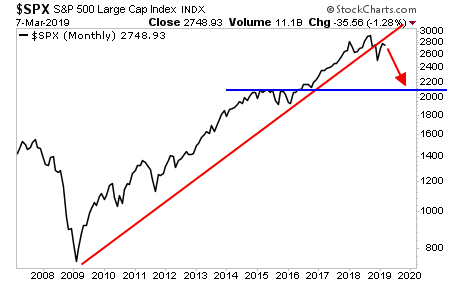

Indeed, in the Big Picture the stock market telling us that the bull market is OVER.

The fact is that the long-term monthly S&P 500 chart shows a CLEAR rejection at its former bull market trendline. There’s really not much but air between here and 2,050 or so on the S&P 500.

That’s a 25% drop from here… so we’re talking about a literal CRASH.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research