While stocks continue to push higher, the bond market is quietly preparing for disaster.

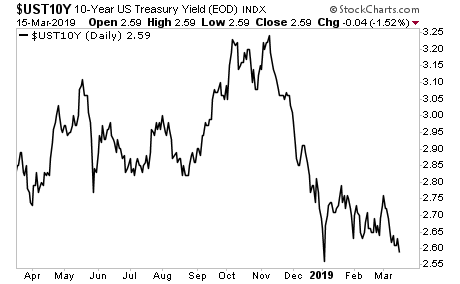

The yield on the 10-Year US Treasury has collapsed to within spitting distance of the December lows. For those with short-term memory issues, that was when investors were piling into Treasuries while stocks were in complete meltdown mode.

————————————————-

This Might Be the Single Best Options Trading System in the Planet

Since inception in 2015, this trading system has produced average annual gains of 41%.

I’m not talking about a single trade… I’m talking gains of 41% per year on the ENTIRE portfolio.

We’re on another winning streak, having closed out a 9%, 12% and another 12% gain in the last four days alone.

With this kind of track record, we’re closing the doors to new subscribers soon.

There are currently fewer than 10 slots left for potential subscribers.

To lock in one of the last slots…

————————————————-

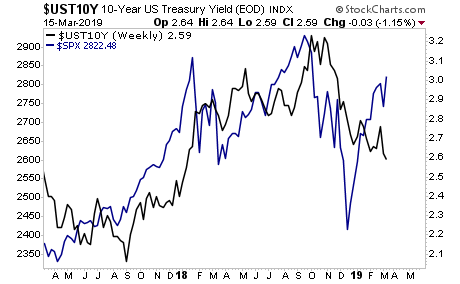

Here’s the weekly chart for the 10-Year Treasury yield (black line) overlaid with the S&P 500 (blue line). As you can see, bonds aren’t buying this rally in stocks, at all.

Put simply, Bonds are showing us that economic growth is GONE in the US. Against this backdrop, stocks are rallying on hopes that the Federal Reserve will start easing monetary policy.

This is an EXTREMELY dangerous situation.

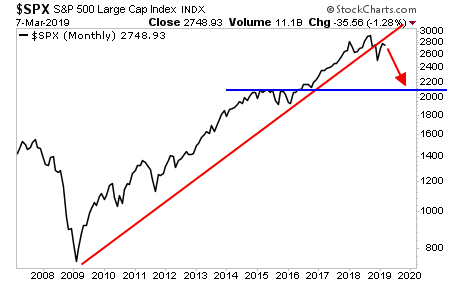

Combined with the fact the long-term stock market charts shows that it’s been rejected at its former bull market trendline, this tells us the bull market is OVER.

What comes next, won’t be pretty.

If you aren’t actively taking steps to prepare for this, you need to start NOW.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research