More and more “risk on” sectors are signaling that the stock market is topping.

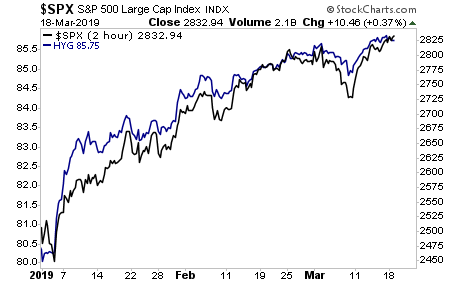

High Yield Credit lead stocks to the upside during this rally. It’s now stalled and is rolling over.

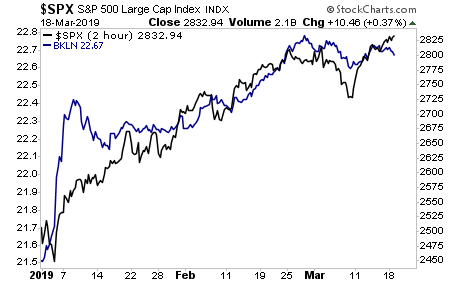

The same is true for leveraged loans (loans made to companies at risk of default). This sector peaked in late February and has already begun to correct.

————————————————-

This Might Be the Single Best Options Trading System in the Planet

Since inception in 2015, this trading system has produced average annual gains of 41%.

I’m not talking about a single trade… I’m talking gains of 41% per year on the ENTIRE portfolio.

We’re on another winning streak, having closed out a 9%, 12% and another 12% gain in the two weeks alone.

With this kind of track record, we’re closing the doors to new subscribers soon.

There are currently fewer than 7 slots left for potential subscribers.

To lock in one of the last slots…

————————————————-

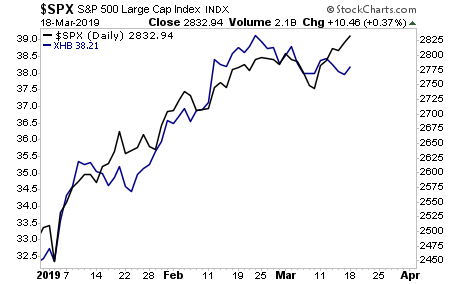

It’s the same story for housing.

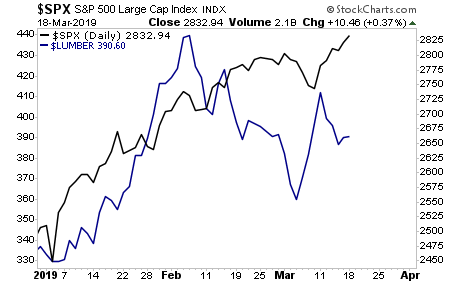

Lumber.

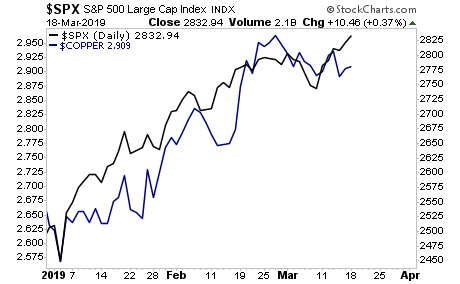

And Copper.

Stocks are pricing in economic perfection: an environment in which growth is high and inflation controlled. Every other risk asset is pricing in a weak economy that will soon trigger a significance “risk off” event AKA possible crash.

Choose wisely…

If you aren’t actively taking steps to prepare for this, you need to start NOW.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research