Central Banks have created the single most dangerous environment possible…

That is the environment in which the economy is weakening, but investors are pouring into risk assets based on hopes that Central Banks will engage in more stimulus.

This is precisely what happened in the late ‘90s as well as in late 2007-early 2008.

Will the outcome be different this time?

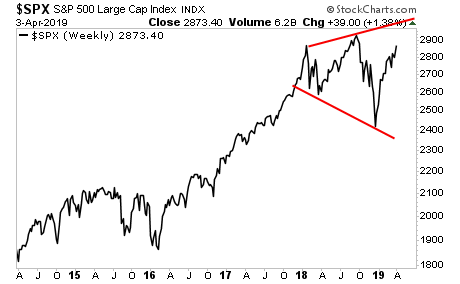

In the near-term, traders will gun the market to new all-time highs. We’re too close for them not to. And until institutions start selling in droves again, we’re in a “trader’s games” market.

This means north of 3,000 on the S&P 500.

This doesn’t make sense… but markets never make sense during bubbles.

The bigger issue is what comes after that breakout to new all-time highs.

And THAT is where you need to be worried.

————————————————-

This Might Be the Best Options Trading System on the Planet

Since 2015, this trading system has produced average annual gains of 41%

I’m not talking about a 41% gain on a single trade… I’m talking gains of 41% per year on the ENTIRE portfolio.

Just yesterday we locked in a 20% gain on a trade we held for only two days.

With this kind of track record, we’re closing the doors to new subscribers soon.

There are currently fewer than 3 slots left for potential subscribers.

To lock in one of the last slots…

Click Here Now!

————————————————-

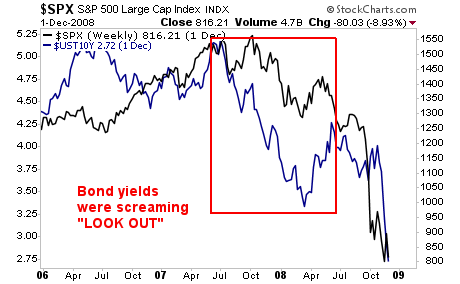

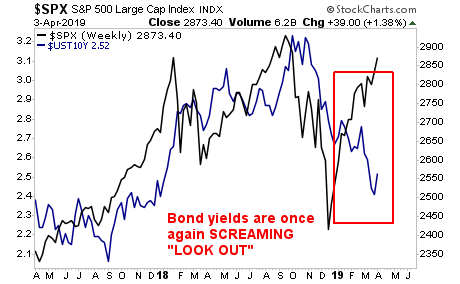

The bond market typically predicts disaster long before stocks “get it.” We saw this in 2008 where bond yields rolled over to new lows while stocks continued to rally… right up until the CRASH…

…And they are doing it now too.

So enjoy the rally while it lasts, but don’t be fooled. What’s coming won’t be pretty. And if you’re interested in profiting from it, the time to prepare is now.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research