Do you know Harry Markopolos?

Harry was the man who knew Bernie Madoff was a fraud… years before Madoff was caught.

At a time when everyone, including the most elite analysts on Wall Street were buying into the hype, Harry knew better… and he did something about it… he talked.

You can learn a lot from people like Harry… people who see things for what they truly are and are willing to go against the crowd.

When asked how he knew that Madoff was a fraud, Harry stated that he saw Madoff’s performance was going in a near perfectly straight line upwards.

As Harry put it:

“You just don’t get straight lines in finance.”

If you see a straight line in finance… it’s a fraud.

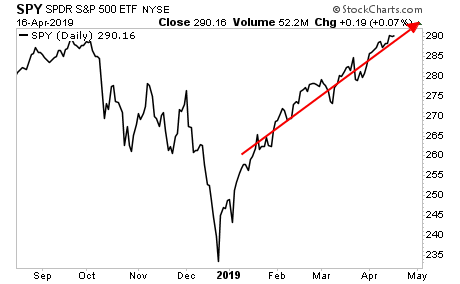

I’ve been thinking about Harry’s quote a lot lately… especially when I see charts like this:

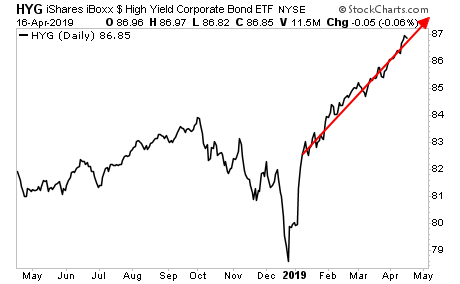

And this…

————————————————-

This Might Be the Best Options Trading System on the Planet

Since 2015, this trading system has produced average annual gains of OVER 50%

I’m not talking about a over 50% gain on a single trade… I’m talking gains of OVER 50% per year on the ENTIRE portfolio.

Just yesterday we locked in a 20% gain on a trade we held for only two days.

With this kind of track record, we’re closing the doors to new subscribers soon.

There are currently fewer than 3 slots left for potential subscribers.

To lock in one of the last slots…

————————————————-

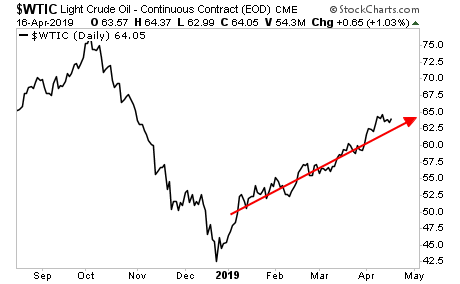

And this…

Isn’t it a little strange, that the single most important asset classes for reflating the financial system (the S&P 500, junk bonds, and oil) all moved in straight lines in the three months after the market “bottomed” in December?

Isn’t it odd that these straight lines started around the time the Treasury Secretary called the Plunge Protection Team… and told the entire world he was doing it?

Isn’t it odd that every single time the market comes close to breaking down, “someone” suddenly puts in a massive “BUY” order to prop things up?

If you’re like me…you probably find it very odd indeed… you might even suspect there is a reason that things are being held together while a campaign is underway to push for cash grabs, NIRP and even wealth taxes in the US.

Consider the following:

- The IMF has already called for a wealth tax of 10% on NET WEALTH.

- More than one Presidential candidate for the 2020 US Presidential Race has already openly called for a wealth tax in the US.

- Polls suggest that the majority of Americans support a wealth tax.

Are stocks wealth?

Would a stock market that is up a massive amount mean larger pools of capital that the Fed and others can seize and then use when things get ugly?

Is this actually all just one gigantic trap?

We think it is…

Indeed, we’ve uncovered a secret document outlining how the Fed plans to both seize and STEAL savings during the next crisis/ recession.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

You can pick up a FREE copy at:

http://phoenixcapitalmarketing.com/GWG.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research