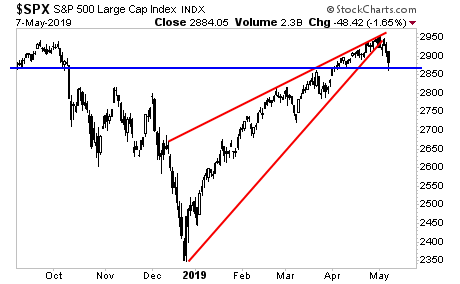

The markets are now on very thin ice.

The S&P 500 has broken is rising wedge formation (red lines). The market only just maintained critical support (blue line) via a late day intervention yesterday. If that line is taken out today, the S&P 500 could easily gap down another 50+ points to the low 2,800s.

That’s actually the best-case scenario right now. The reality is that numerous economic bellwethers are predicting the market will fall much LOWER than that.

————————————————-

The Opportunity From Triple, Even QUADRUPLE Digit Gains is Here

Market volatility can mean MASSIVE profits with the right trading system.

I’ve got it… we’ve already locked THREE Double Digit gains this week: 11%, 12% and 16%… all of which we held less than a week.

And the REAL market moves haven’t even started yet!

The doors close to this trading system tonight at midnight.

To lock in one of the last slots…

————————————————-

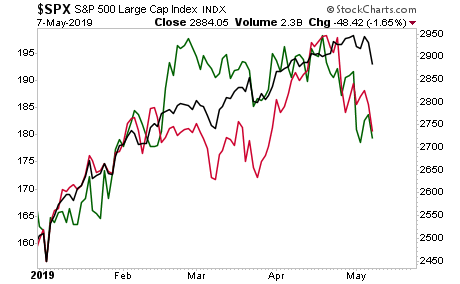

That’s actually the best-case scenario right now. The reality is that numerous economic bellwethers are predicting the market will fall much LOWER than that.

Both Copper (green line) and shipping/ mail giant Fed Ex (red line) suggest the S&P 500 will end up around the low 2,700s. That’s a full 5% lower from where stocks are now.

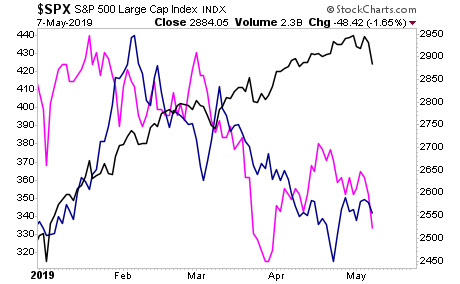

Meanwhile, two other economic markers, Lumber (blue line) and the yield on the 10-Year US Treasury (pink line), are even lower suggesting the S&P 500 is heading to the low 2,500s. That would mean stocks falling another 12%.

What are the odds that Lumber, Copper, Fed Ex, and Treasury Yields are ALL wrong… and stocks are right?

Not much.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

As I write this, there are only 27 copies left.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research