The stock market is primed for a bounce.

Bears had their chance to take out support yesterday and failed.

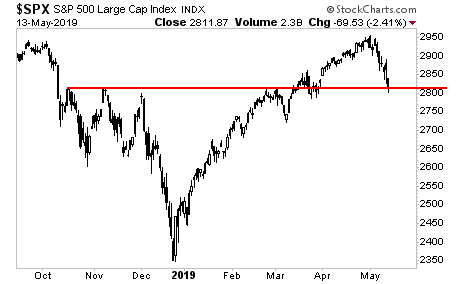

Stocks held the most important line (red line below), suggesting it’s time for a bounce.

————————————————-

The Opportunity For Triple, Even QUADRUPLE Digit Gains is Here

Market volatility can mean MASSIVE profits with the right trading system.

I’ve got it… we’ve already locked THREE Double Digit gains this week: 11%, 12% and 16%… all of which we held less than a week.

Our next trade goes out this morning… to get in on it…

————————————————-

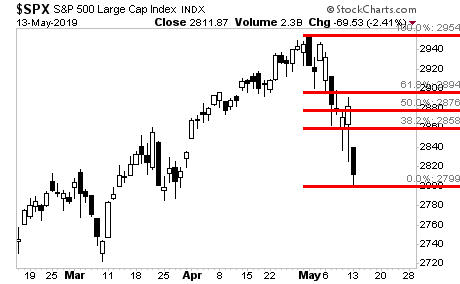

Here are the Fibonnaci ratios for a bounce. The simplest move would be a dead cat bounce to the 2,880s.

Do NOT think of this as the start of something major… the bull market is over. We are officially in a bear market.

Put another way, the stock market is NOT breaking down based on the single issue of US/ China trade talks deteriorating… it is breaking down because the global economy has and the stock market is overpriced for a weak economy.

Put simply… stocks traded in the first half of this year as though 2H19 would be fantastic… and it’s now clear that it won’t…

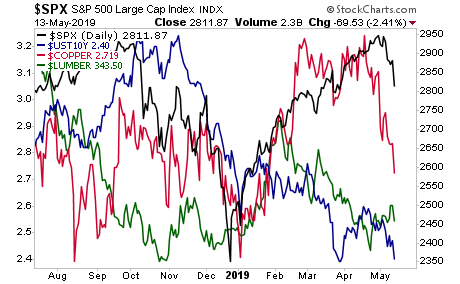

We’ve had repeated warnings from other asset classes that this is the case.

Copper (red line) suggests the S&P 500 should eventually fall to 2,600… while Lumber (green line) and Treasury yields (blue line) suggest 2,450 or even 2,350 will be the ultimate downside target.

If you’re looking for a road map to successfully trade this environment… we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research