The trade deal is officially dead… and the market has begun grieving…

Now, there are five stages to grieving… and the market is slowing working its way through all five of them…

They are: denial, anger, bargaining, depression and acceptance

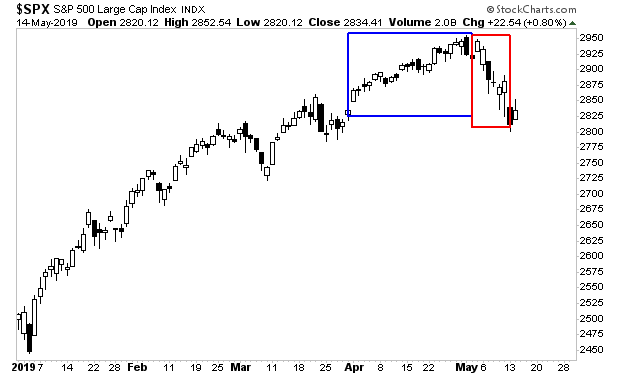

The “denial stage” was most of April… when it was plain as day a trade deal was not coming… but stocks kept holding up… that is represented by the blue square in the chart below.

The “anger stage” started with a vengeance in May… when the market entered a multi-week drop. That stage is represented by the red square in the chart below.

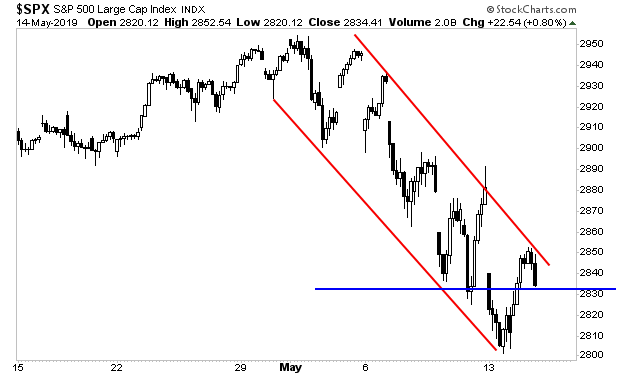

Which brings us to the “bargaining stage”… in which the market believes that somehow or another the trade deal might be salvaged. As a result, stocks are attempting to break out of their downtrend to stage a significant bounce.

This might last a week or two… but then will come the depression stage… followed by the acceptance stage.

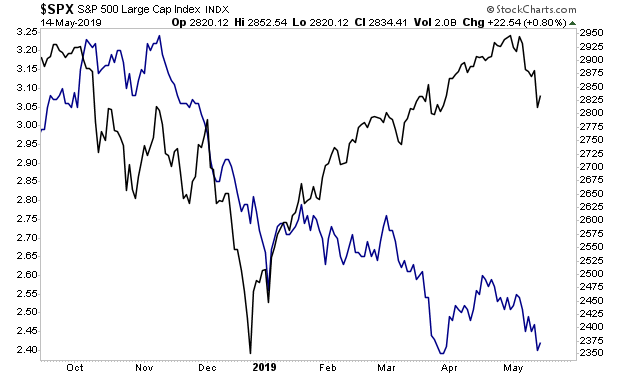

Those stages will see stocks finally “give up hope” and collapse to where other asset classes that are more closely aligned with what’s REALLY happening in the global economy… specifically BONDS… are trading.

If you’re looking for a road map to successfully trade this environment… we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research