As I noted yesterday, this rally looks to have legs… for now.

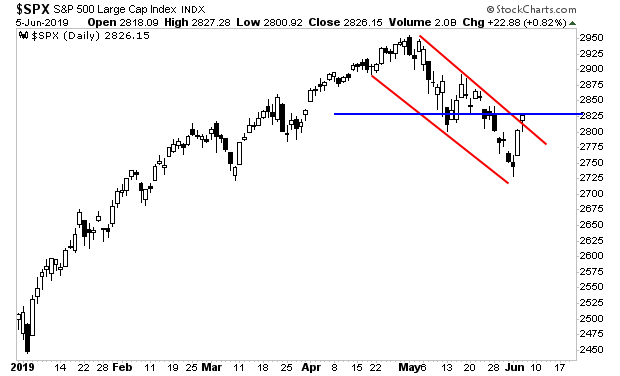

The stock market broke out of its downtrend yesterday (red lines). It remains below resistance (blue line). A break to the upside here, would open the door to a run to 2,900 on the S&P 500.

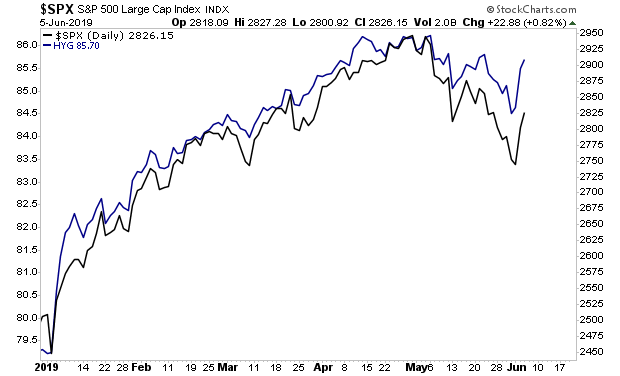

Again… this is where credit suggests stocks will move. Junk Bonds hit the equivalent levels of 2,910 on the S&P 500 yesterday.

This again would confirm my thesis that this rally has a week or more to go.

After that, the real action begins.

The real action will consist of stocks giving up all hope of a China/ US trade deal being made…

Right now stocks are pinning their hopes on President Trump and Chinese President Xi Jinping coming to some kind of agreement at the G-20 meeting in Osaka Japan on June 28th-June 29th.

This won’t happen.

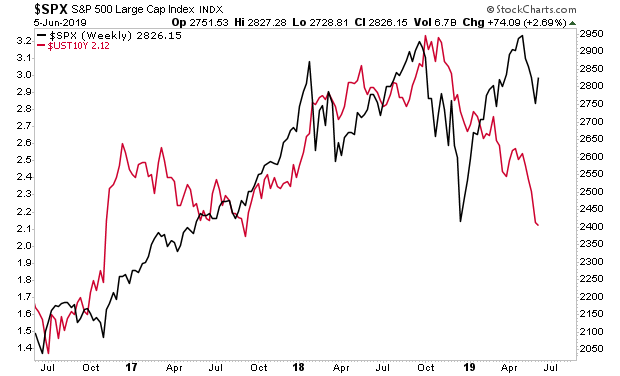

If it was… the Treasury market would have signaled that we are entering a period of economic stability.

That has not been the case. Treasury yields have continued to drop, telling us that the economy is weakening rapidly… and that NO trade deal is coming.

A Crash is coming…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research