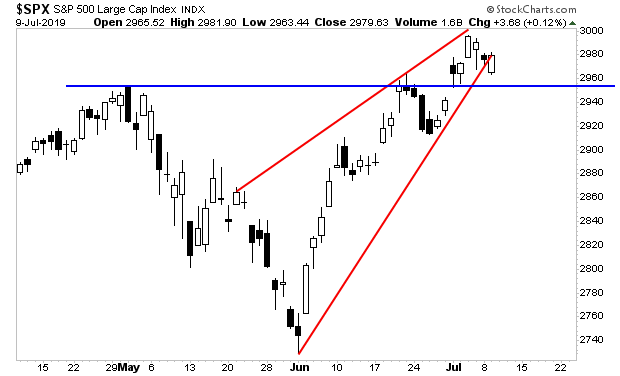

Stocks broke the lower trendline of their bearish rising wedge yesterday.

The drop would have been greater, but the investment world is waiting to see what Fed Chair Jerome Powell has to say to Congress today.

Powell is in a truly horrible position. It is clear the global economy is rolling over. The U.S. economy continues to fare well, but that won’t continue for long if the rest of the world deteriorates.

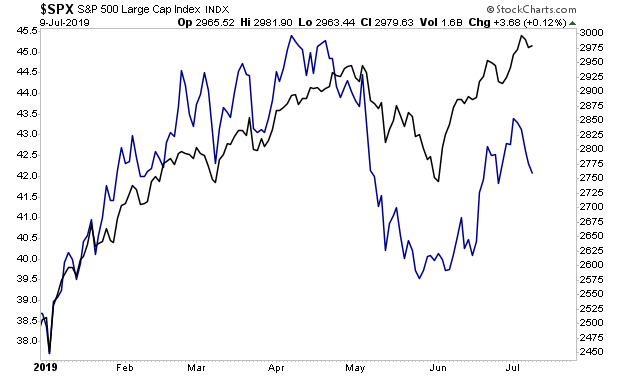

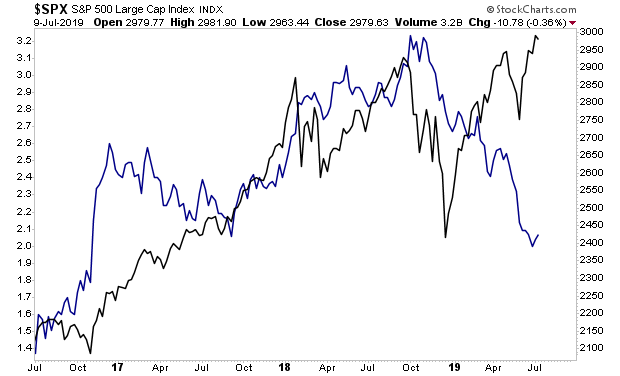

Moreover, China’s stock market has revealed that a Trade Deal is not coming. The country that has the most to gain from the trade war ending is China. And its stock market has rolled over and is dropping like a stone.

Will the Fed cut rates in July or will it not? Does it even matter? Could the U.S. possible escape the carnage if the world enters a recession?

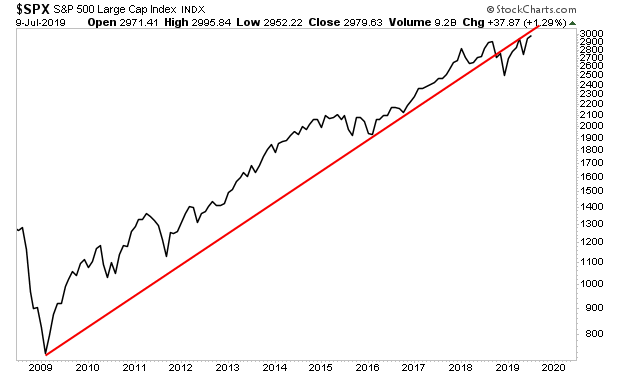

Most importantly, can stocks regain their bull market trendline?

Bonds say “NO!”

Be PREPARED if the market is surprised by Powell, we could get some REAL FIREWORKS!

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research