Happy New Year’s Eve!

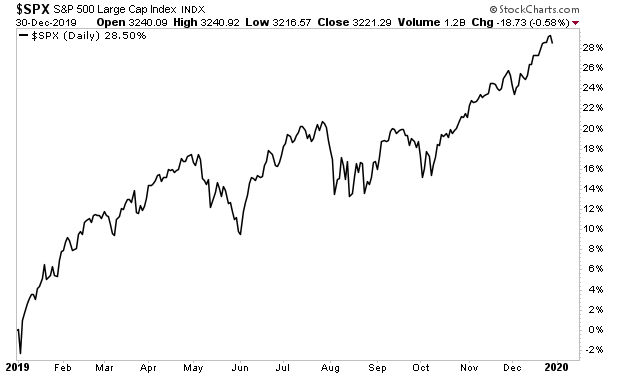

As we wind down 2019, stocks are making a small pullback. Barring a complete meltdown today, stocks are about to finish 2019 with gains of over 28%.

That’s an incredible return for a single year. And 2020 is looking to be just as bullish.

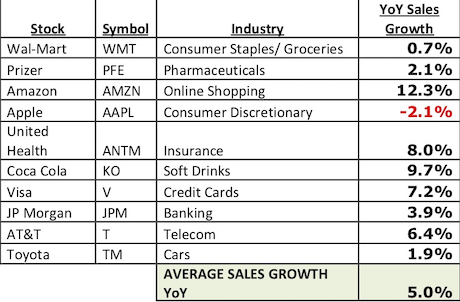

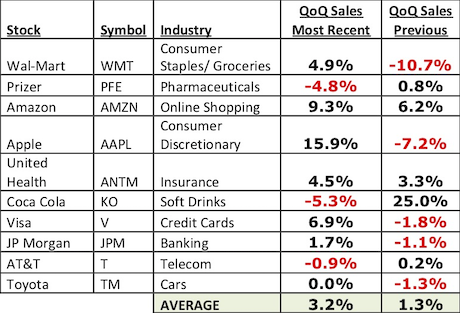

Forget earnings, forget the economy, forget the trade deal, forget all of the stuff the media tells you to focus on. The markets carte about one thing and on thing only: LIQUIDITY.

And there is a TSUNAMI of it coming in 2020.

Consider the following:

1) Money supply is growing at 7.4% per year.

2) The Fed is putting roughly $100 billion into the financial system every month.

3) Corporations will buyback nearly $600 billion worth of their own stock next year.

4) Investors are sitting on $3.4 trillion in cash.

Between the Fed and corporate buybacks alone, there will be $1.8 TRILLION in liquidity hitting the financial system next year. That’s an amount roughly equal to the GDP of Italy.

———————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

This offer ends forever in 2019. Which means you have less than 24 hours to lock it in.

To snatch it for yourself…

———————————————————–

Now consider what happens if stocks and the economy continue to fare well and investors choose to move some of the $3.4 trillion in cash back into the markets.

We’re talking about the S&P 500 hitting 4,000 by year-end 2020.

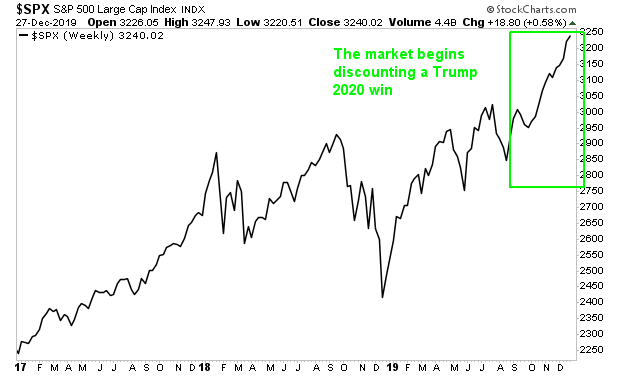

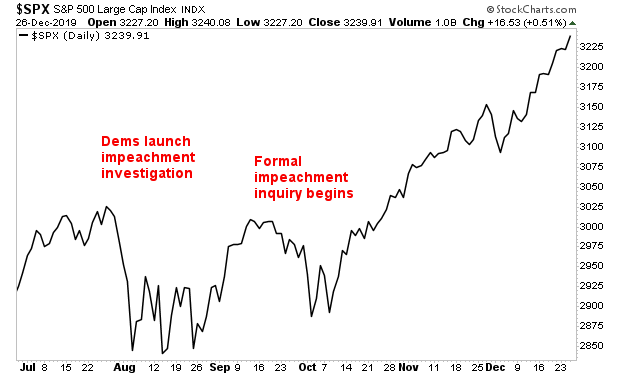

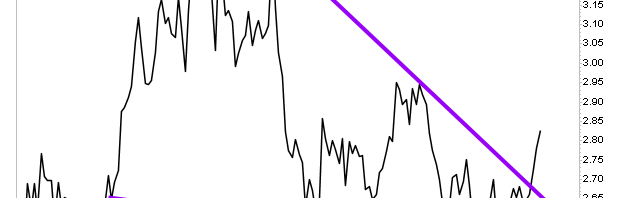

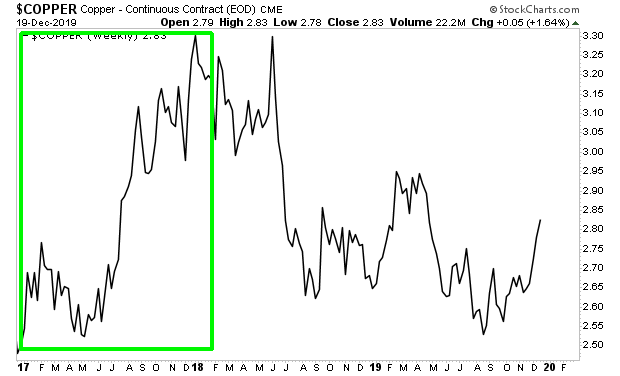

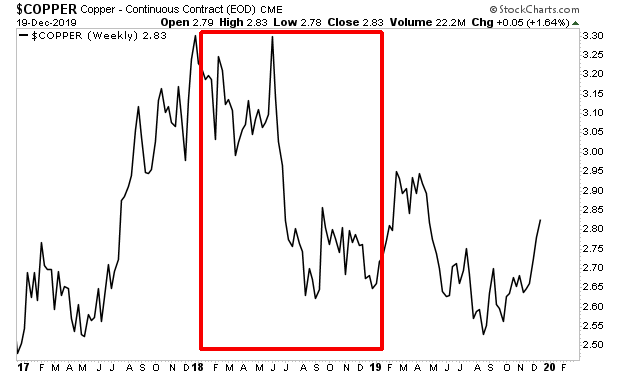

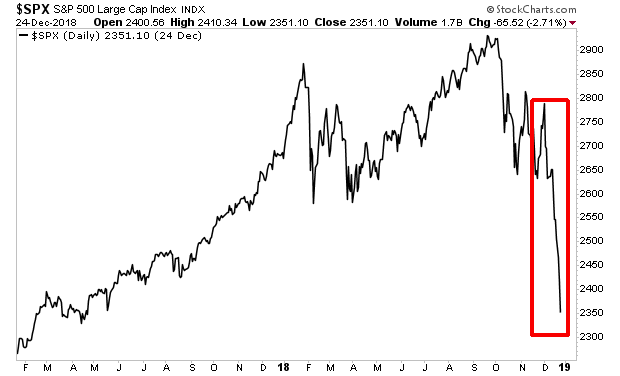

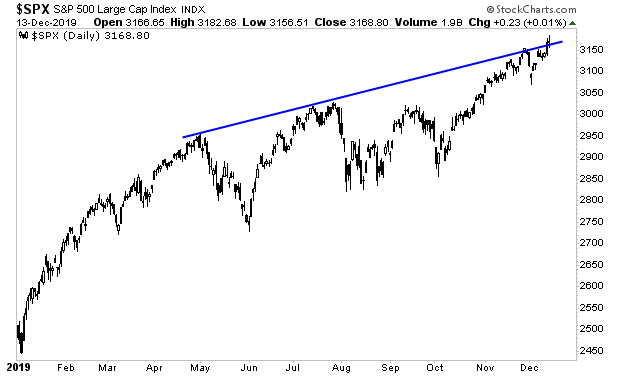

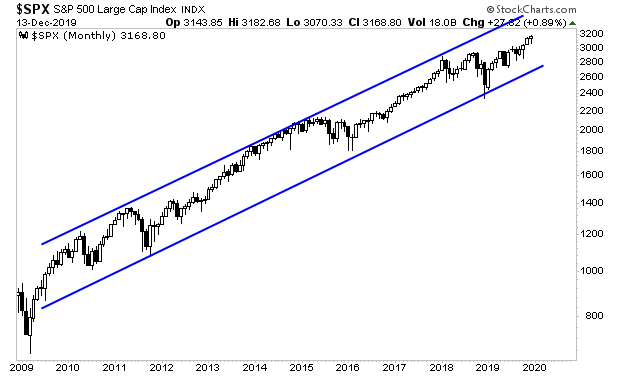

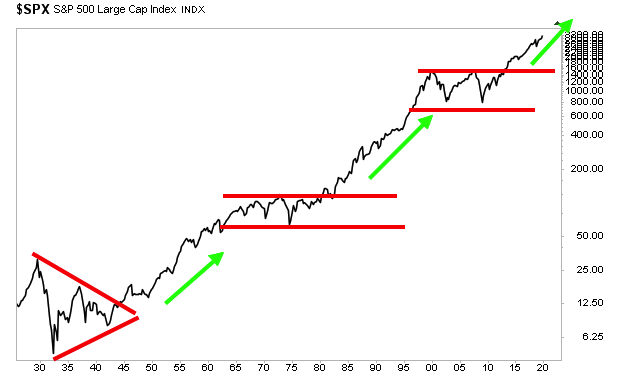

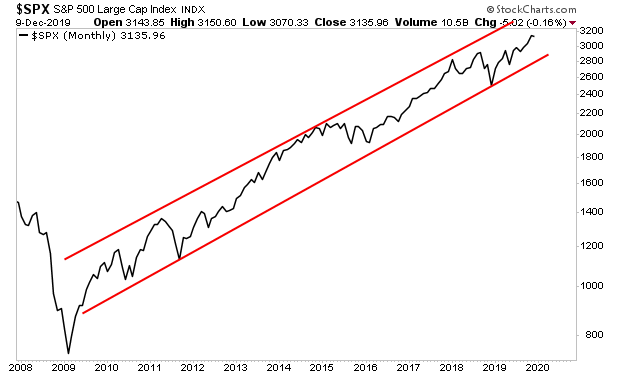

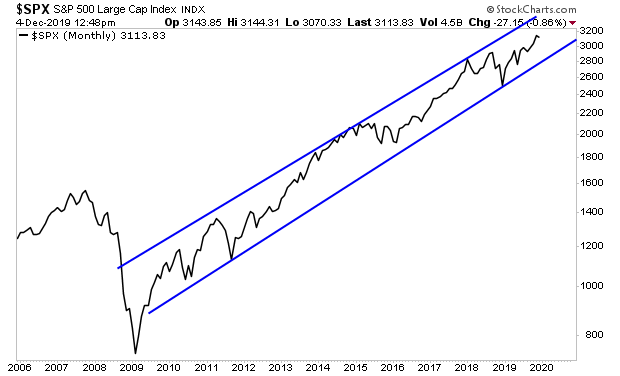

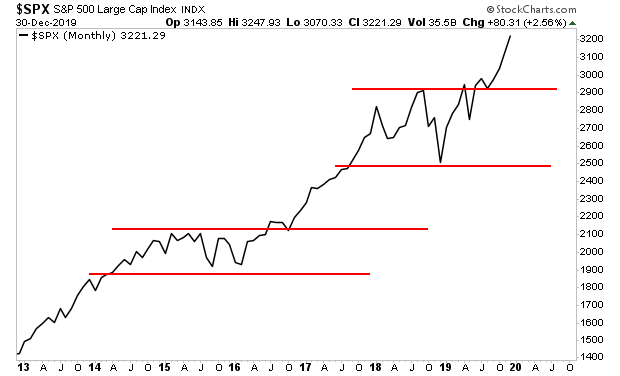

If you think this sounds extreme, consider that stocks just broke out of a multi-year consolidation pattern similar to that of 2014-2017 in late last year. During the last breakout, the market roared higher by 700 points… and that was without the Fed easing monetary policy.

A similar move this time around would put the S&P 500 at 3,600. Throw in the Fed’s extreme monetary easing and 4,000 on the S&P 500 isn’t hard to reach.

If you’re not preparing to profit from this, NOW is the time to do so!

Indeed, we’ve discovered a unique play on stocks… a single investment… that has already returned 1,300%. And we believe it’s poised to more than TRIPLE in the next 24 months as the stock market roars higher.

To find out what it is… pick up a copy of our report…The Last Bull Market of Our Lifetimes

There are fewer than 9 copies left.

Graham Summers

Chief Market Strategist

Phoenix Capital Research