That last post sure caused a ruckus.

In case you missed it, the premise was very simple.

This is the last bull market of our lifetimes.

I realize that sounds like a crazy statement.

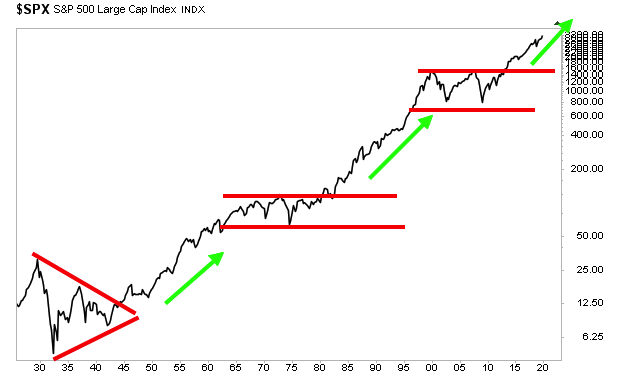

So, I want you to take a look at this chart.

As you can see, there have been THREE bull markets in the last 100 years (identified with green arrows).

- From 1945-1967

- Another from 1983-2000.

- The one that began in mid-2013.

Short-sided analysts will argue that stocks have been in a bull market since 2009. But the reality is that from 1997 until mid-2013, stocks effectively went nowhere. If your 401K went up, it was due to contributions, not stock market returns.

Yes, we only JUST entered a new bull market in mid-2013. Prior to that, stocks had gone NOWHERE for 15/16 years.

Which means…

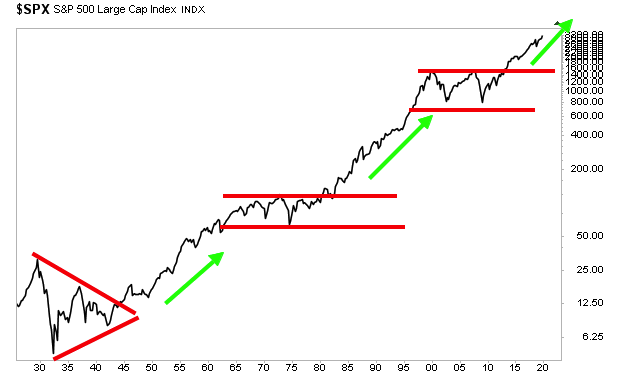

When this bull market ends, stocks will once again enter a bear market: a period in which stocks go nowhere, or worse, LOST money for 15 years straight.

We’ve had three of them in the last 100 years. I’ve identified them with the red lines in the chart below:

Again, we’re talking about 15 years, MINIMUM during which stocks DON’T make money. Which means if this current bull market ends in 2021, stocks will have peaked until at least 2036.

Put simply, NOW is the time to maximize your gains from the stock market.

Why?

Because it’s your last chance, likely in your lifetime.

If you’re looking for a means to profit from this, we just published a new investment report titled The Last Bull Market.

In it we outline how the bull market will unfold… which investments will perform best… and a unique play that more than TRIPLES the return of the broader stock market.

We are giving away just 99 copies of this report for FREE to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/TLBM.html

Best Regards,

Graham Summers

Chief Market Strategist

Phoenix Capital research