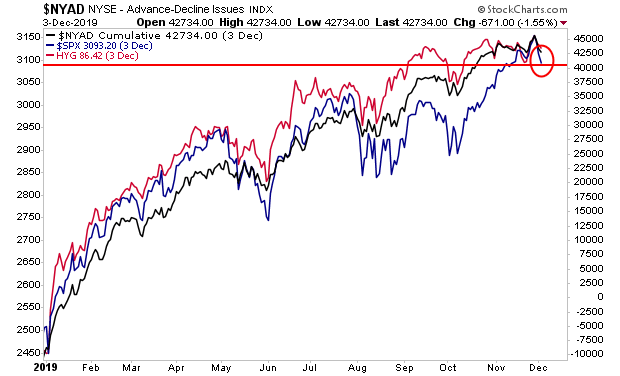

The market correction we’ve been predicting to our clients for the last three weeks finally hit. The S&P 500 caught up with both breadth and high yield credit to within spitting distance of our downside target of 3,070 or so.

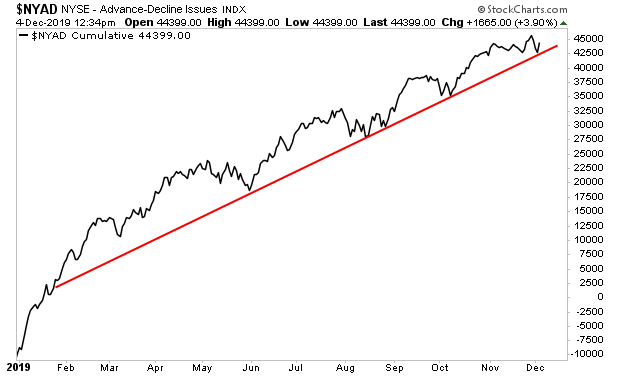

The key chart for this bull market has been breadth. And breadth has bounced off the uptrend that has marked the lows for most corrections this year.

It’s truly incredible the bears couldn’t generate more pronounced selling. This strongly suggests that stocks are nowhere near a significant market top.

———————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

We have only 10 remaining slots available for this offer.

To snatch one of them for yourself…

———————————————————–

Indeed, the AAII survey continues to show that investor sentiment is nowhere near the bullish insanity one needs to see to claim there is a mania underway. The bulls sit at 33.6%, well below the historic AVERAGE of 38%.

Let me repeat that, the number of bulls is BELOW the historic average at a time when stocks have just hit new all-time highs (this latest reading was BEFORE stocks began to correct this week).

On top of this, investors are sitting on $3.4 trillion in cash… at a time when the Fed is literally broadcasting that it’s going to let inflation run hot.

What do you think is going to happen when inflation starts rising and eating away at all that cash sitting on the sidelines?

Investors will be forced to move into riskier assets to maintain their purchasing power. And if even $1 trillion of that $3.4 trillion in cash does this, we’re talking about the S&P 500 hitting 4,000 next year.

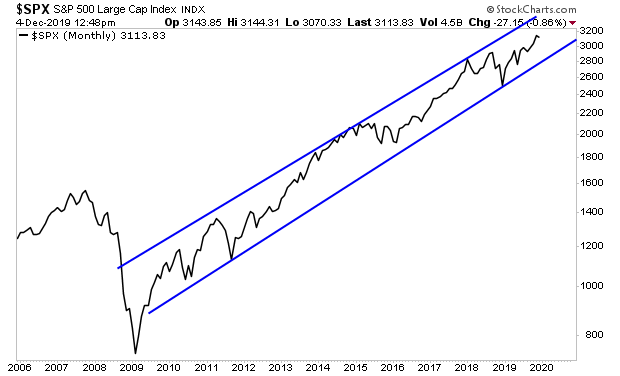

The bull channel from the 2009 low remains intact. When this correction completes in the coming days, the market will move to touch the upper trendline in mid-2020.

If you’re looking for a means to profit from this, we just published a new investment report titled The Last Bull Market.

In it we outline how the bull market will unfold… which investments will perform best… and a unique play that more than TRIPLES the return of the broader stock market.

We are giving away just 99 copies of this report for FREE to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/TLBM.html

Best Regards,

Graham Summers

Chief Market Strategist

Phoenix Capital research