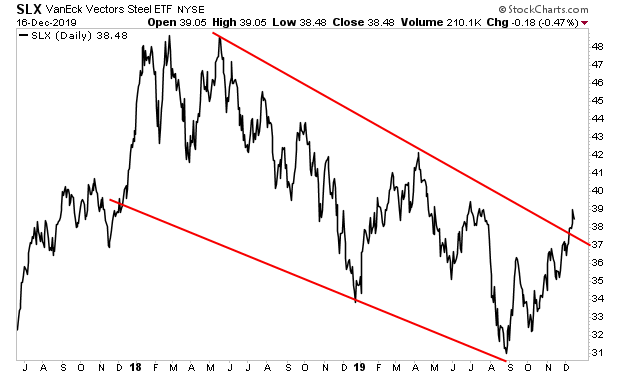

Yesterday, I noted that the beaten down steel industry was beginning to turn up.

Steel is an industrial metal used closely aligned with economic growth. With that in mind, the below chart suggests that the downturn from early 2018 until mid-2019 is ending and that we are entering a period of boom, not bust.

This is the first of MANY such charts.

———————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

We have only 7 remaining slots available for this offer.

To snatch one of them for yourself…

———————————————————–

The doom and gloomers tell us that the U.S. is on the verge of a recession, but the market disagrees. Everywhere I look I see breakouts and new highs.

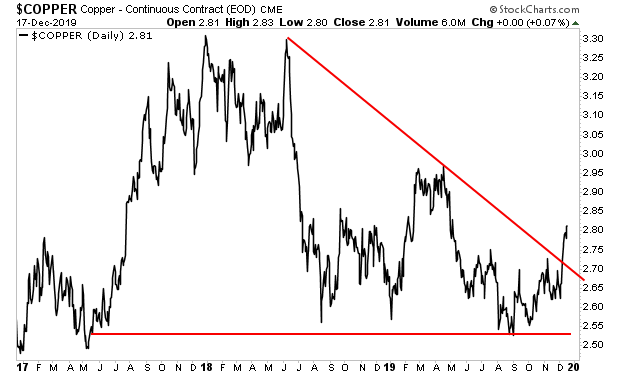

Steel is just one such example. Take a look at Copper.

Here again we have a breakout signaling that the downturn from early 2018 until mid-2019 is ending. This again suggests a boom, not a bust, is coming down the pike.

This is EXTREMELY bullish. And I believe that 30% gain since September is just the start. My proprietary models indicate that all claims of an impending recession are completely WRONG.

Instead we’re about to enter an economic boom… one in which undervalued plays like steel could more than DOUBLE in the coming months.

Indeed, we’ve discovered a unique play on stocks… a single investment… that has already returned 1,300%. And we believe it’s poised to more than TRIPLE in the next 24 months.

To find out what it is… pick up a copy of our report…The Last Bull Market of Our Lifetimes

There are fewer than 50 copies left.

Graham Summers

Chief Market Strategist

Phoenix Capital Research