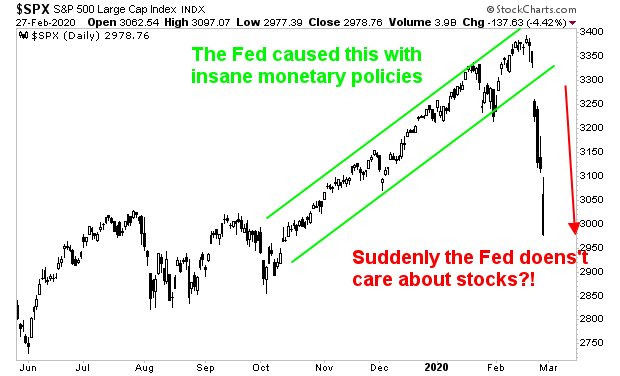

The Fed is once again playing “chicken” with the markets.

For 30+ years the Fed has attempted to pretend it doesn’t care about stocks. Time and again, when the markets start to collapse the Fed pretends it doesn’t care, only to then flip around and intervene.

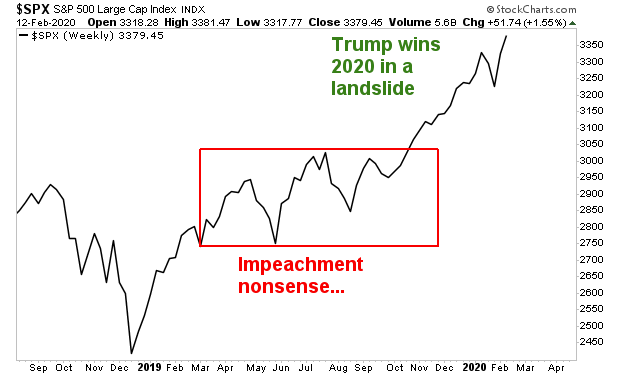

What’s particularly strange about the Fed’s current silence is the fact that it was the Fed that caused the markets to melt-up over the last 14 months via verbal interventions and monetary programs.

Throughout the last 14 months the Fed has talked about introducing nuclear QE, negative interest rates, and even buying stocks outright during the next downturn.

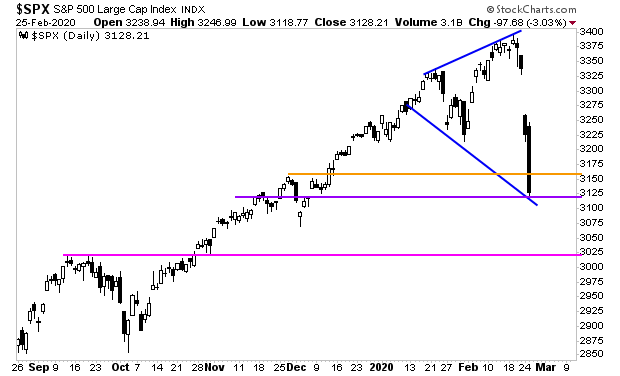

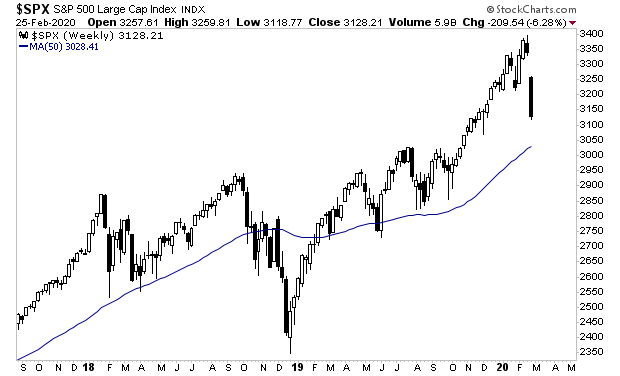

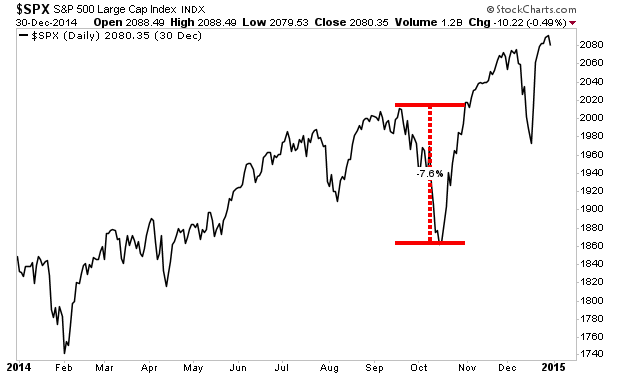

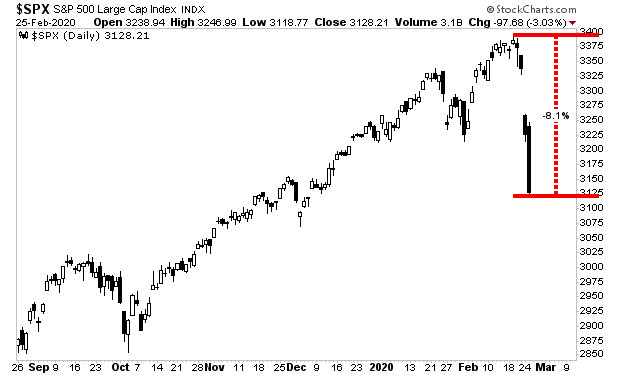

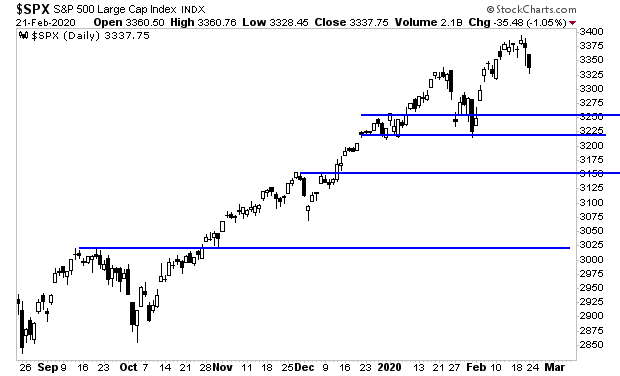

Well, the next downturn is here and suddenly for some reason, the Fed isn’t saying anything. And stocks are imploding, erasing six months’ gains in six days.

Again, the Fed is trying to play “chicken” with the markets. And I believe the market is about to call the Fed’s bluff.

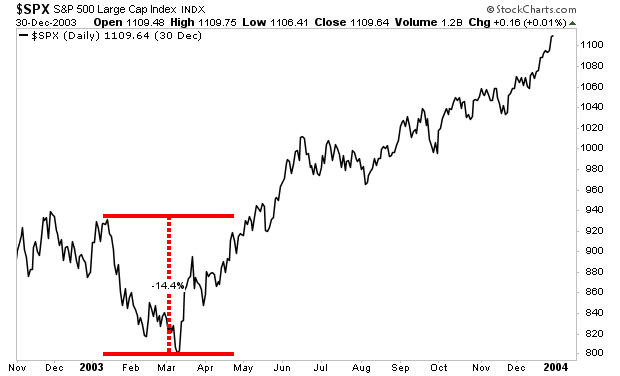

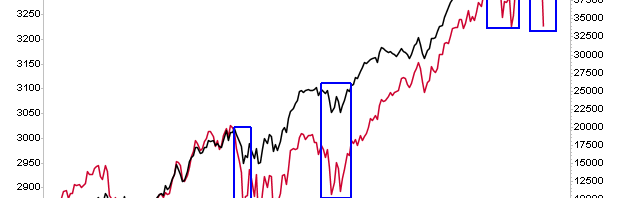

Every time the Fed has attempted to act tough, the market has broken then Fed. This happened in 2010, 2011, and most recently late 2018.

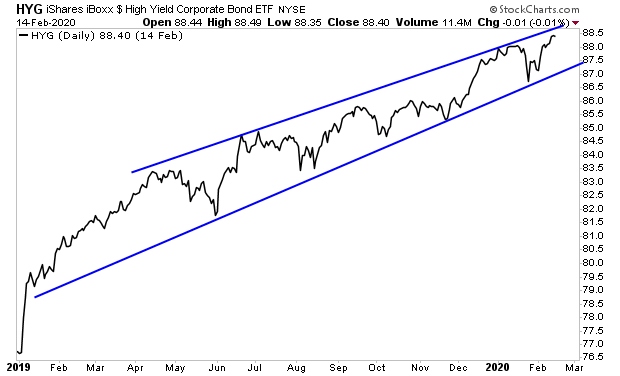

The reason for this is simple… in a financial system as leveraged as that of the US today, even a whiff of deflation is enough to panic the Fed into stepping in to intervene.

This is happening yet again this week… and the Fed has a choice:

1) Intervene and prop up the markets again.

2) Let the markets collapse, let deflation take hold, and officially go on record as the people who allowed another “2008” to happen.

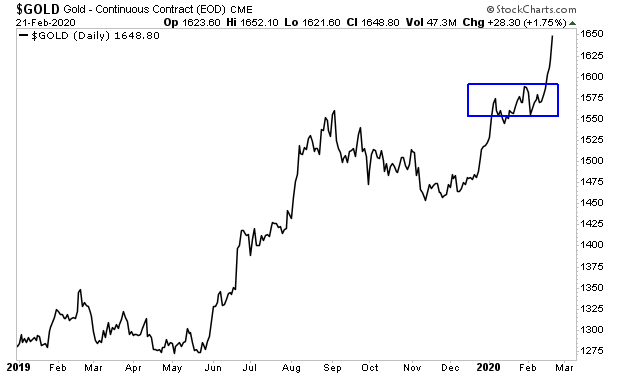

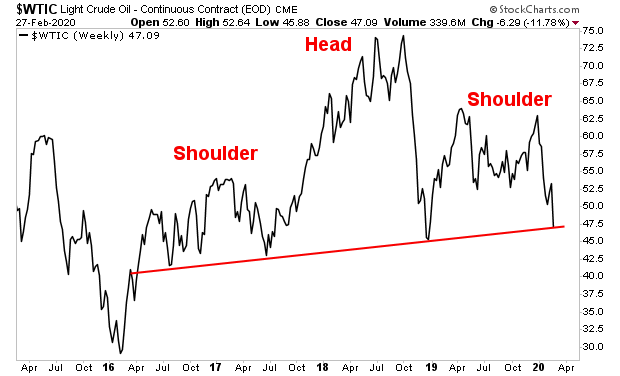

If you think I’m being dramatic here, take a look at the following charts.

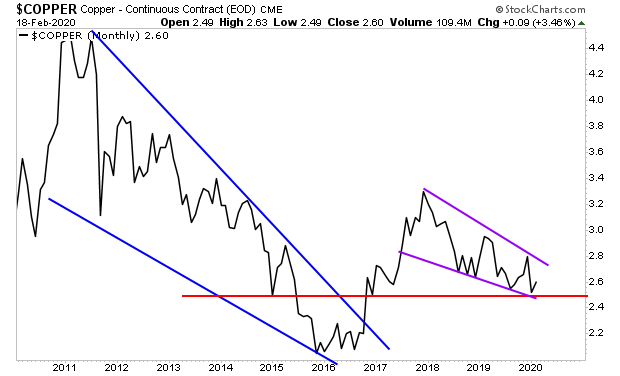

Exhibit A: Oil is carving out a major Head and Shoulders.

Either the Fed begins to intervene or Oil goes to sub-$30 per barrel, and the world enters a deflationary implosion… the very thing the Fed has been trying to stop from happening since 2008.

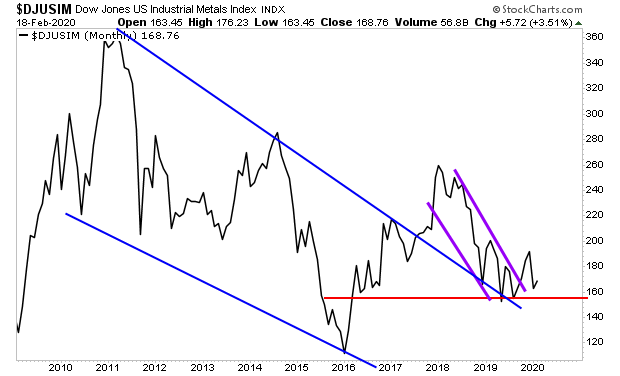

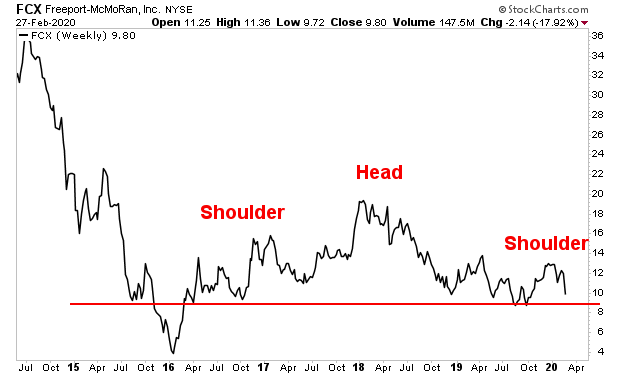

Exhibit B: Freeport McMoran (FCX) is the largest copper producer in the U.S..

Here again we have a massive Head and Shoulders formation. Either the Fed intervenes, or we erase ALL of the gains from the 2016 low and the world sinks into a global deflationary depression a la 2008.

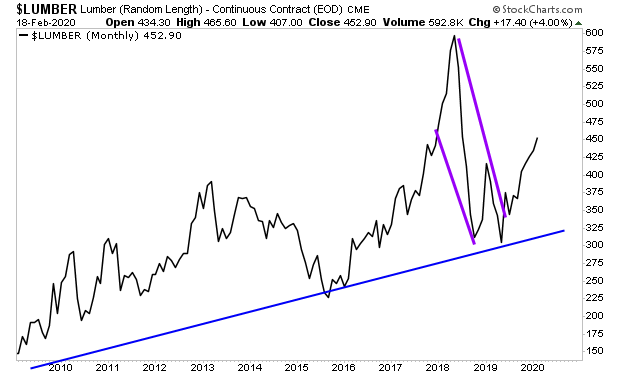

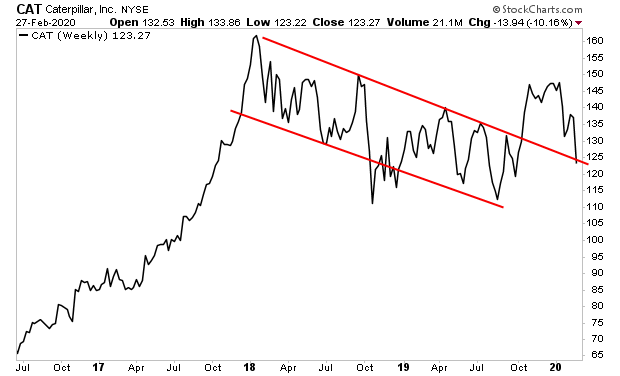

Exhibit C: Caterpillar (CAT) is the largest machinery manufacturer in the world.

Either the Fed starts to intervene and CAT bounces hard here and the “recovery” remains in place, or… we erase ALL of the gains of the last FIVE years’ worth of recovery… and enter a deflationary collapse.

Is this time different?

Has the Fed finally “got religion” and is going to let stocks collapse without intervening?

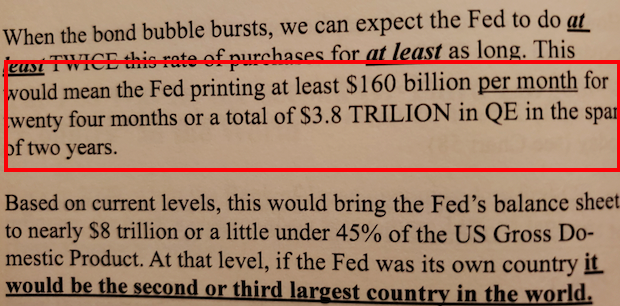

Is the same Fed that buckled like a paper plate a mere 14 months ago, abandoning all of its talk of normalization, introducing three rate cuts, a $60 billion per month QE program, and two separate repo programs suddenly going to let the markets collapse?

It’s possible. But I don’t believe this will be the case.

Considering that every single Fed chair since Paul Volcker has lost every game of “chicken” with the stock market it’s unlikely.

I’m not saying I like the Fed, or even that a Fed intervention is the RIGHT thing to do… I’m just saying that I believe the Fed will lose this game of chicken with the markets and stage and intervening over the weekend or early next week.

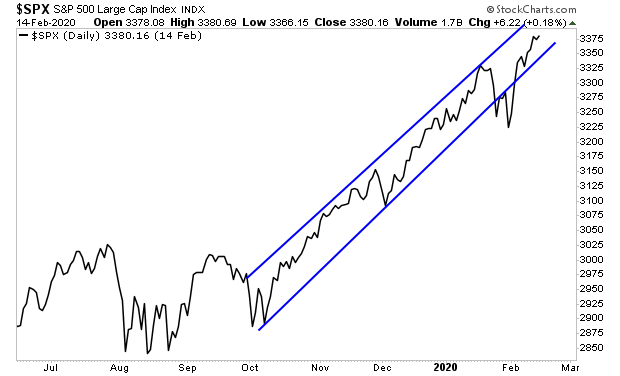

For that reason, personally, I am bullish, INSANELY bullish about the markets.

If things even marginally improve, we are going to get a “rip your face off” V-shaped recovery in the markets.

After all, what are the odds President Trump is going to let his beloved stock market go down the toilet during an election year?

I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

My clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, I detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

In it, I detail five unique investments that I expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research