Yesterday’s article caused quite a stir.

As you know, I’ve been extremely bullish on stocks for the last few months. Much of that bullishness was driven by the fact that the Fed was aggressively easing monetary policy while the economy was still growing at a moderate pace.

Moderate growth + intense money printing = stocks explode higher

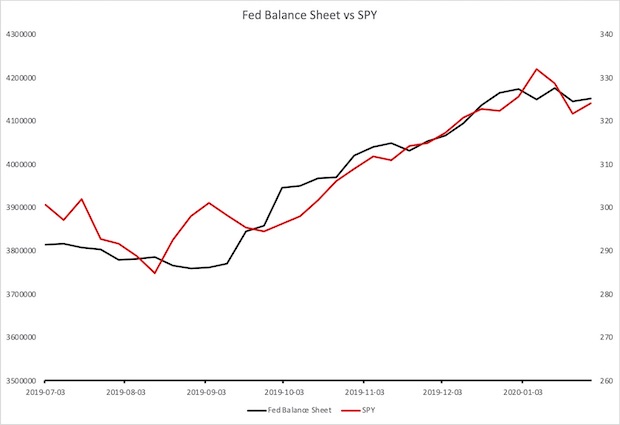

You can see the relationship in the chart below.

The black line represents the Fed’s balance sheet which expands as the Fed prints money. The red line represents the S&P 500. As you can see, once the Fed started expanding its balance sheet in September, stocks erupted higher. Since that time, the two have moved higher in virtual lockstep.

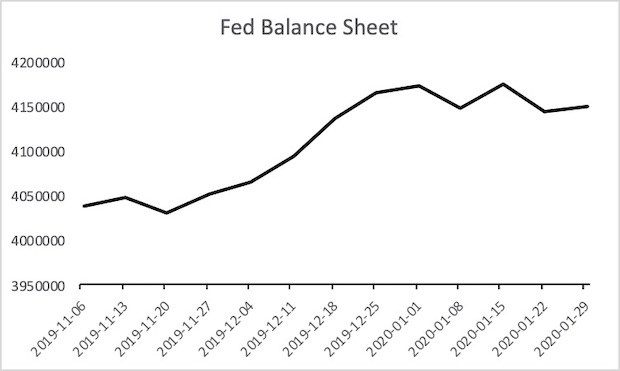

Which is why I’m EXTREMELY concerned about the fact that the Fed has STOPPED printing money in the last month.

Indeed, thus far for 2020, the Fed’s balance sheet has SHRUNKEN by nearly $2 billion. That doesn’t sound like much, but from September through December of last year, the Fed’s balance sheet was GROWING by $100 billion per month.

And suddenly it has stopped.

What is going on here? The Fed is supposedly engaged in a $60 billion per month QE program. And yet its balance sheet has started shrinking.

Is the Fed trying to crash the markets?

It sounds ludicrous, until you consider that the Fed has made it clear that it hates President Trump. Former Fed Vice Chair Stanley Fisher has admitted that the Fed was actually raising interest rates to intentionally damage the economy back in 2018.

So is the Fed gearing up for another act of economic sabotage?

This year 2020 is an election year. Historically, the only times a President has failed to win a second term was when the economy and stock market collapsed

So is the Fed trying to engineer this by sabotaging the stock market “behind the scenes”?

Former head of the NY Fed, Bill Dudley openly called for the Fed to hurt the economy to stop President Trump’s chance of winning a second term in office just a few months ago.

This is an EXTREMELY dangerous situation and one that needs to be monitored closely.

If you haven’t already taken steps to prepare your portfolio for a potential Fed-driven crash, it’s time to pick up a copy of our Stock Market Crash Survival Guide.

Within its 21 pages we outline which investments willperform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research